System updates & optimization reports

Tightened screws, maximized stabilization

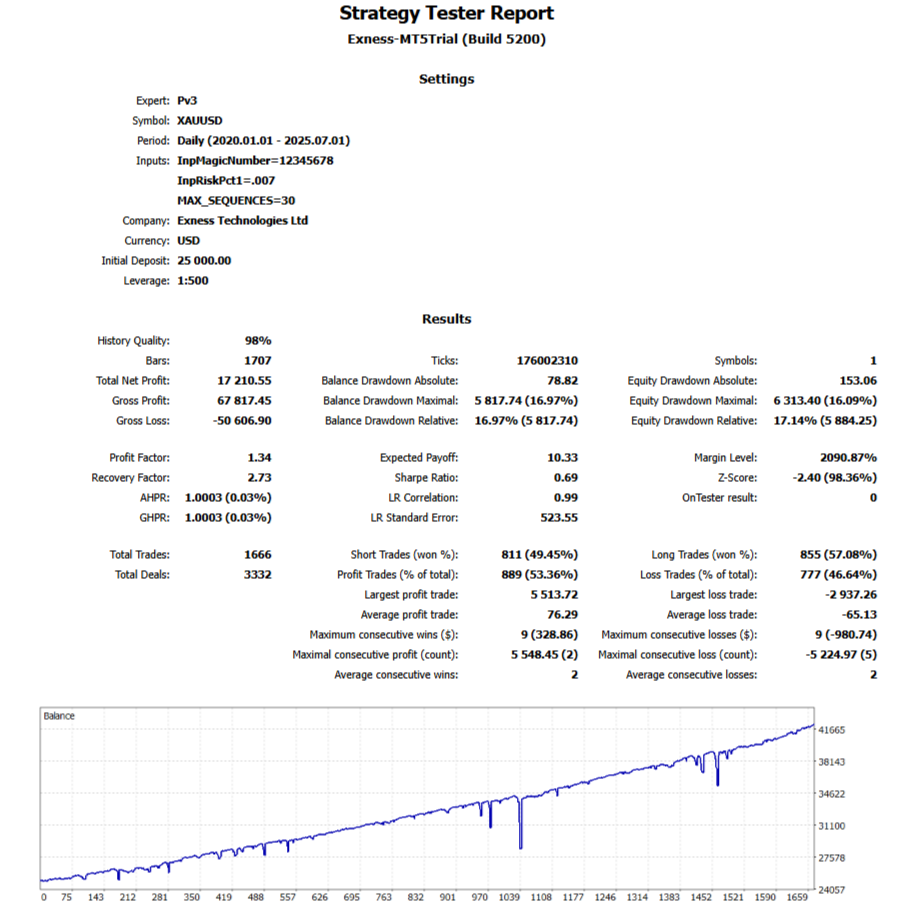

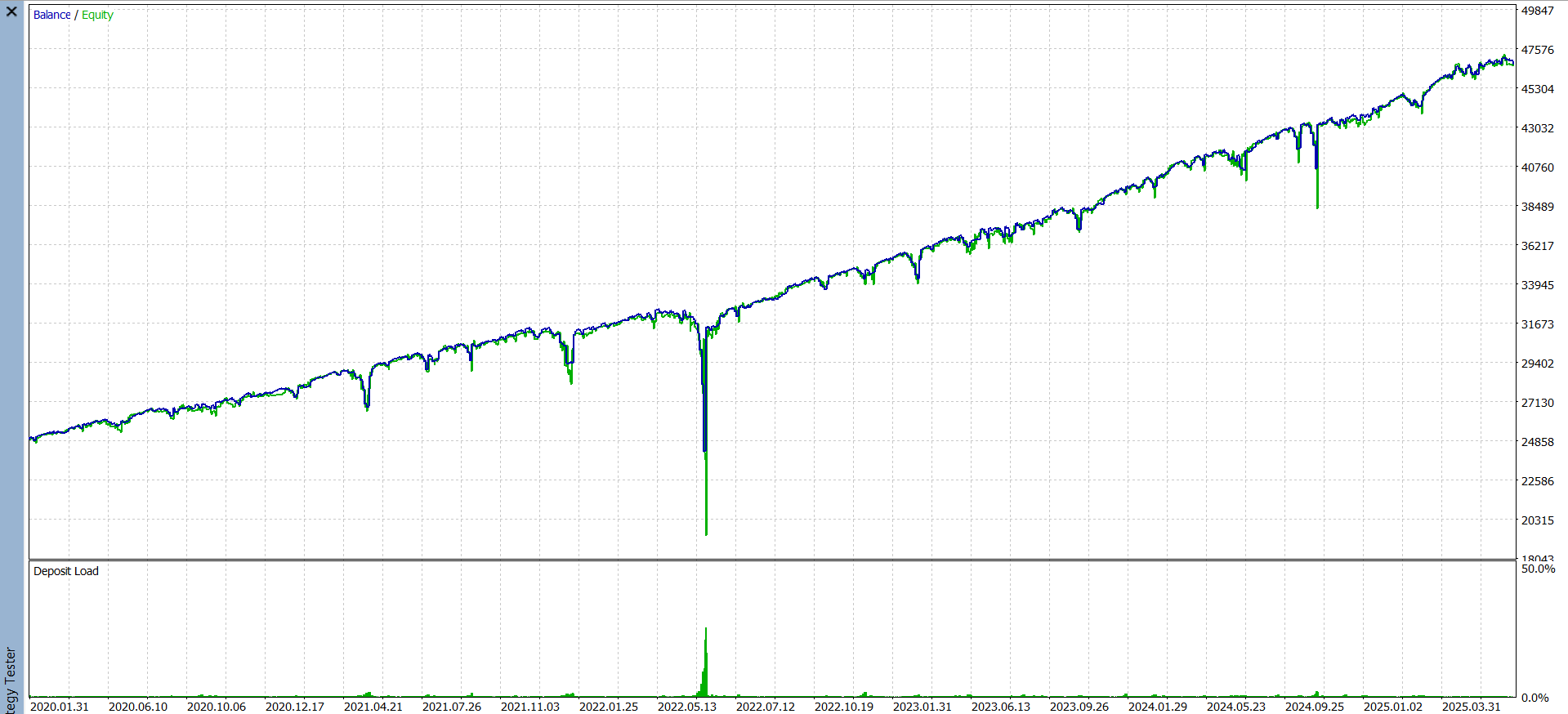

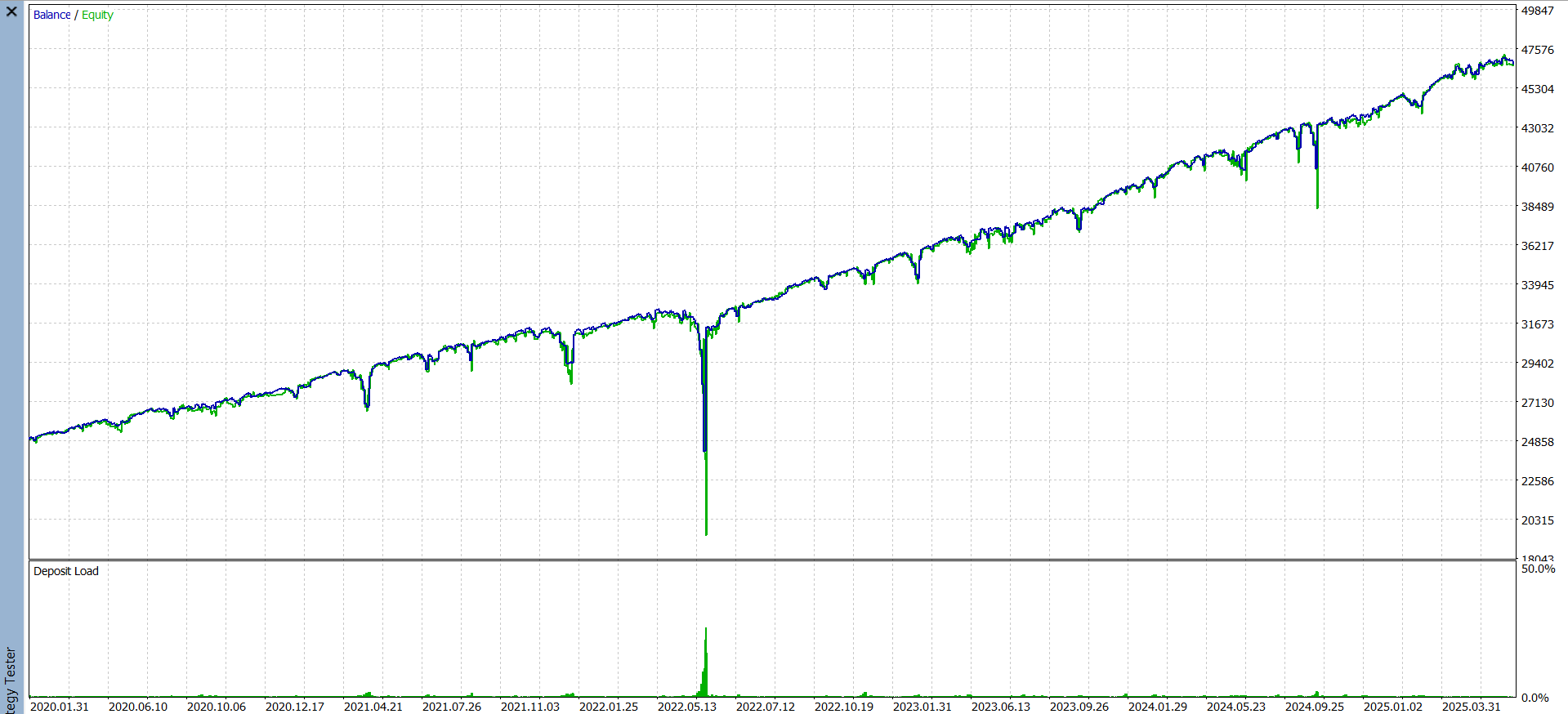

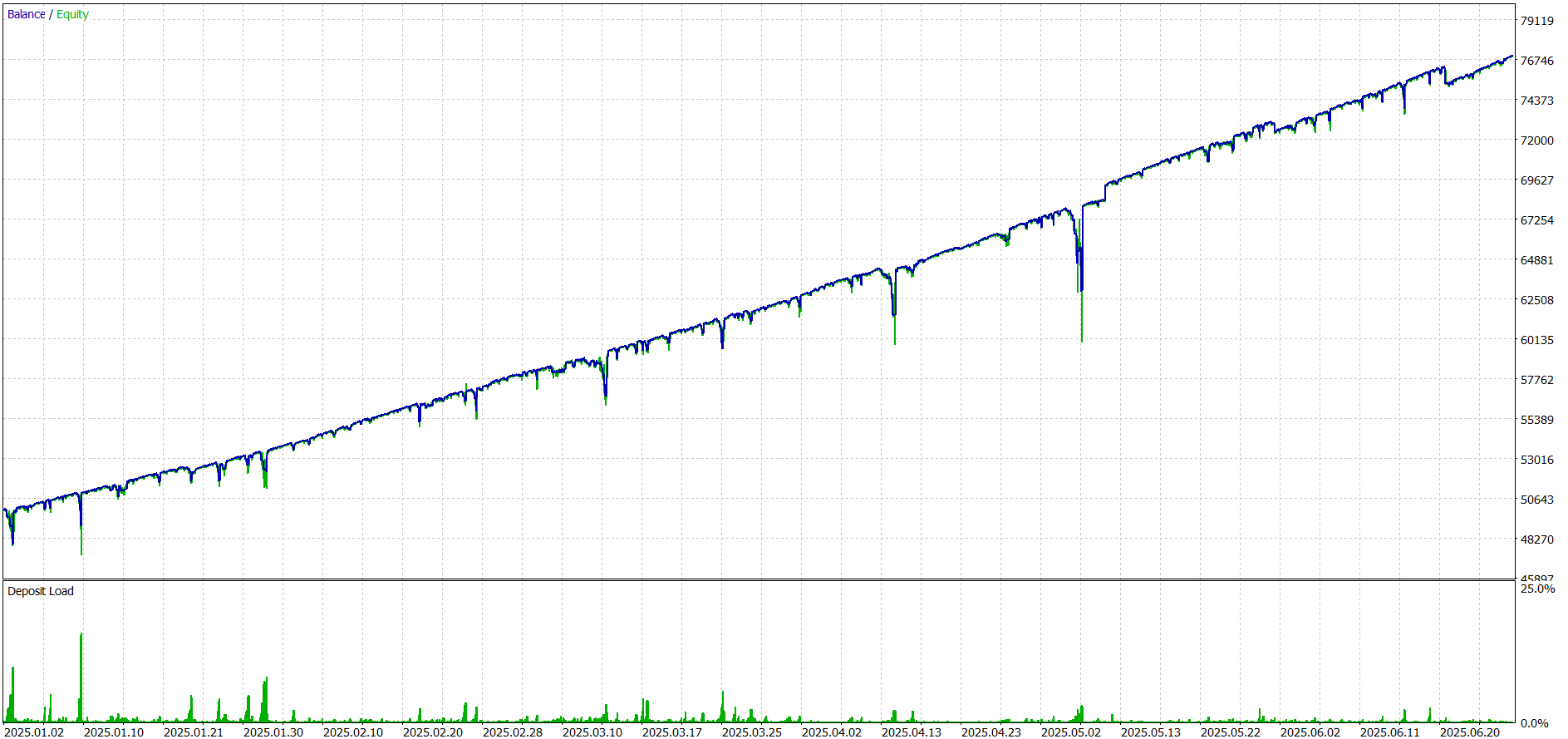

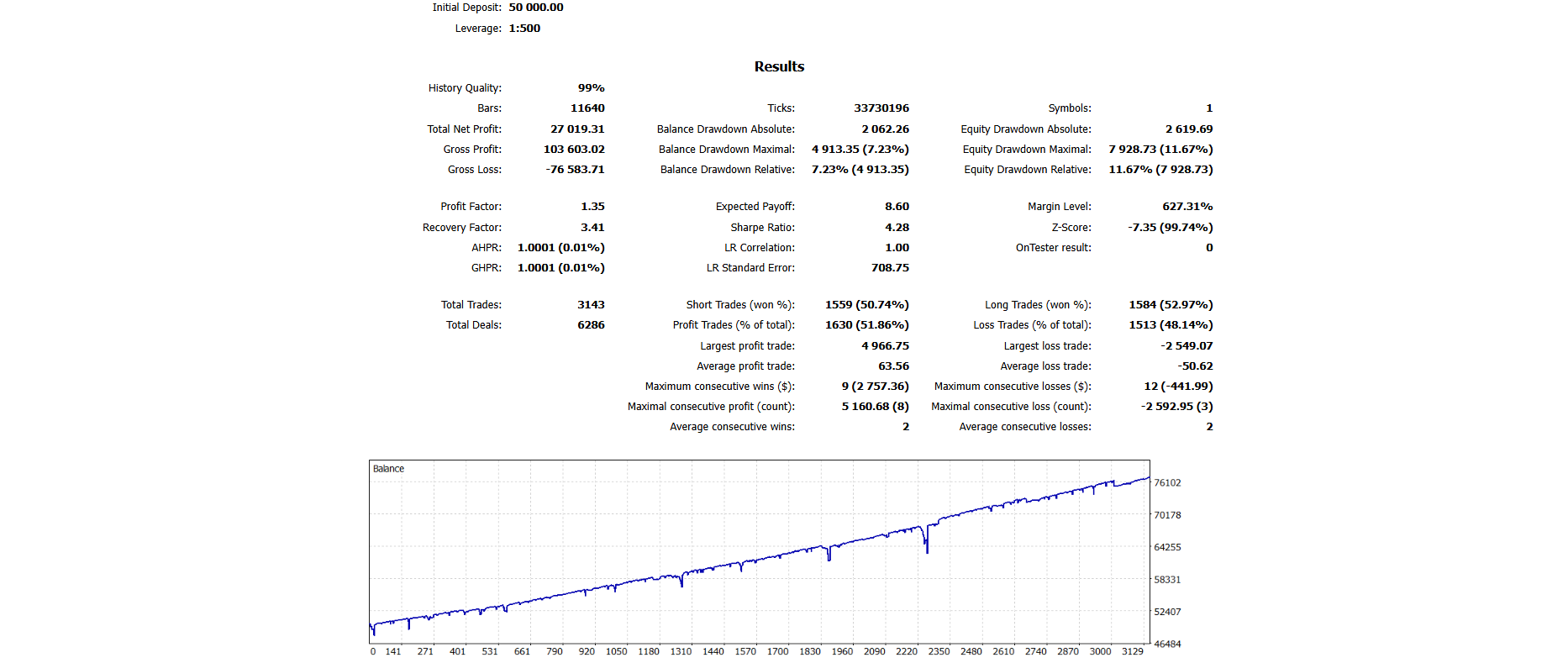

These post-launch pv3 optimization refinements deliver lower drawdown volatility, higher equity stability and smoother curve behavior compared to earlier versions.

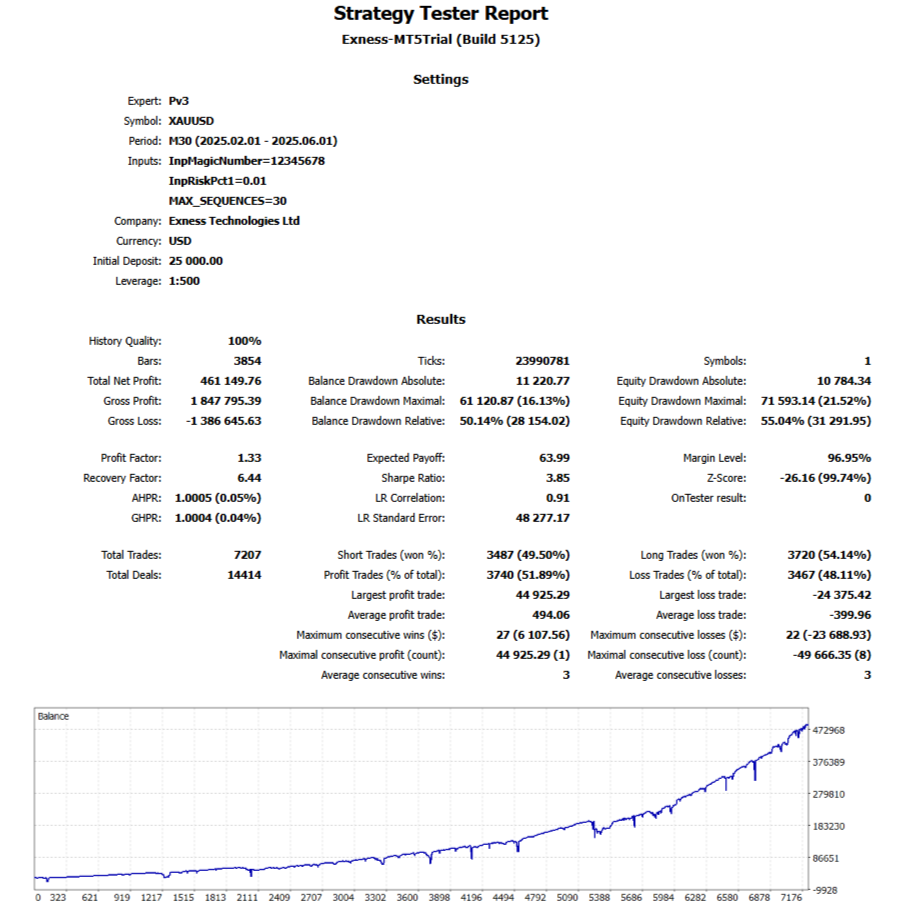

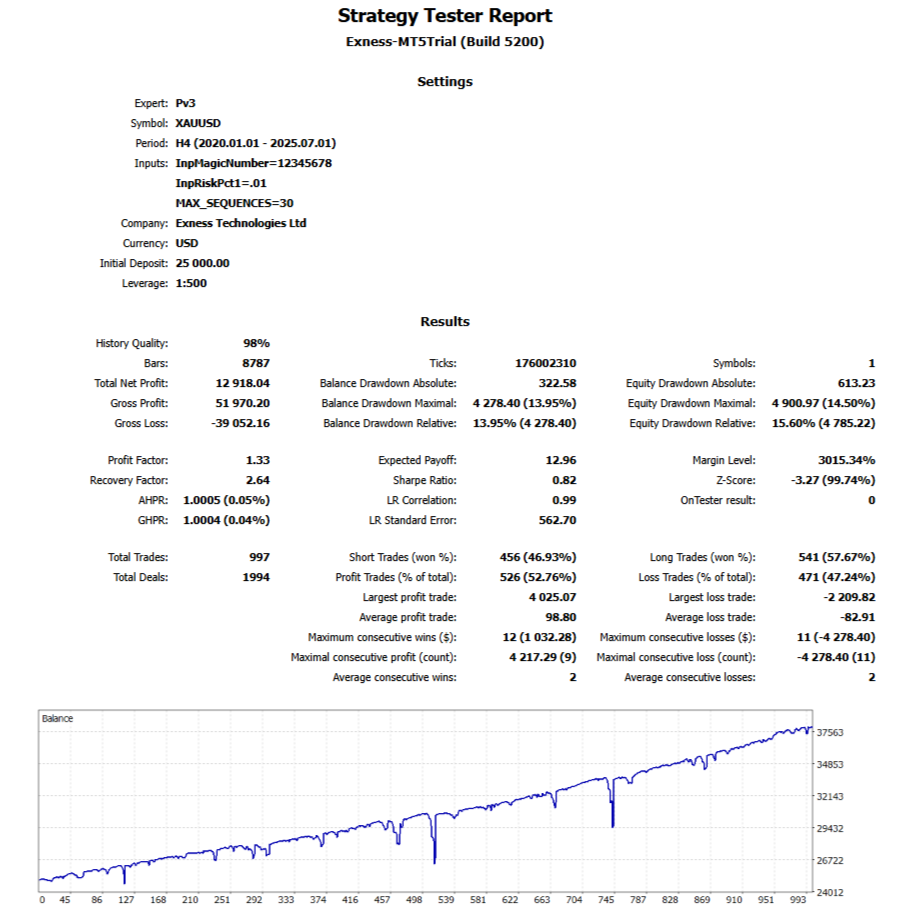

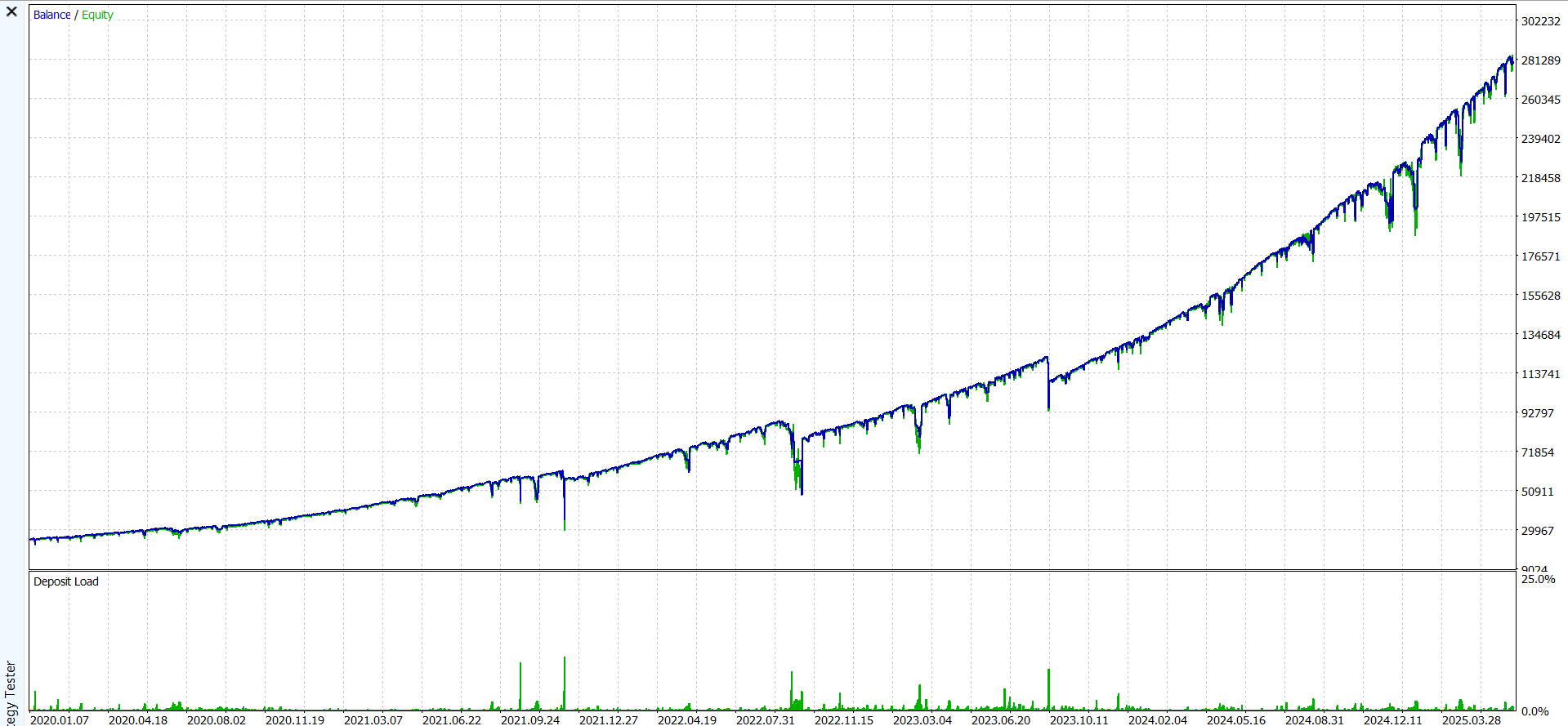

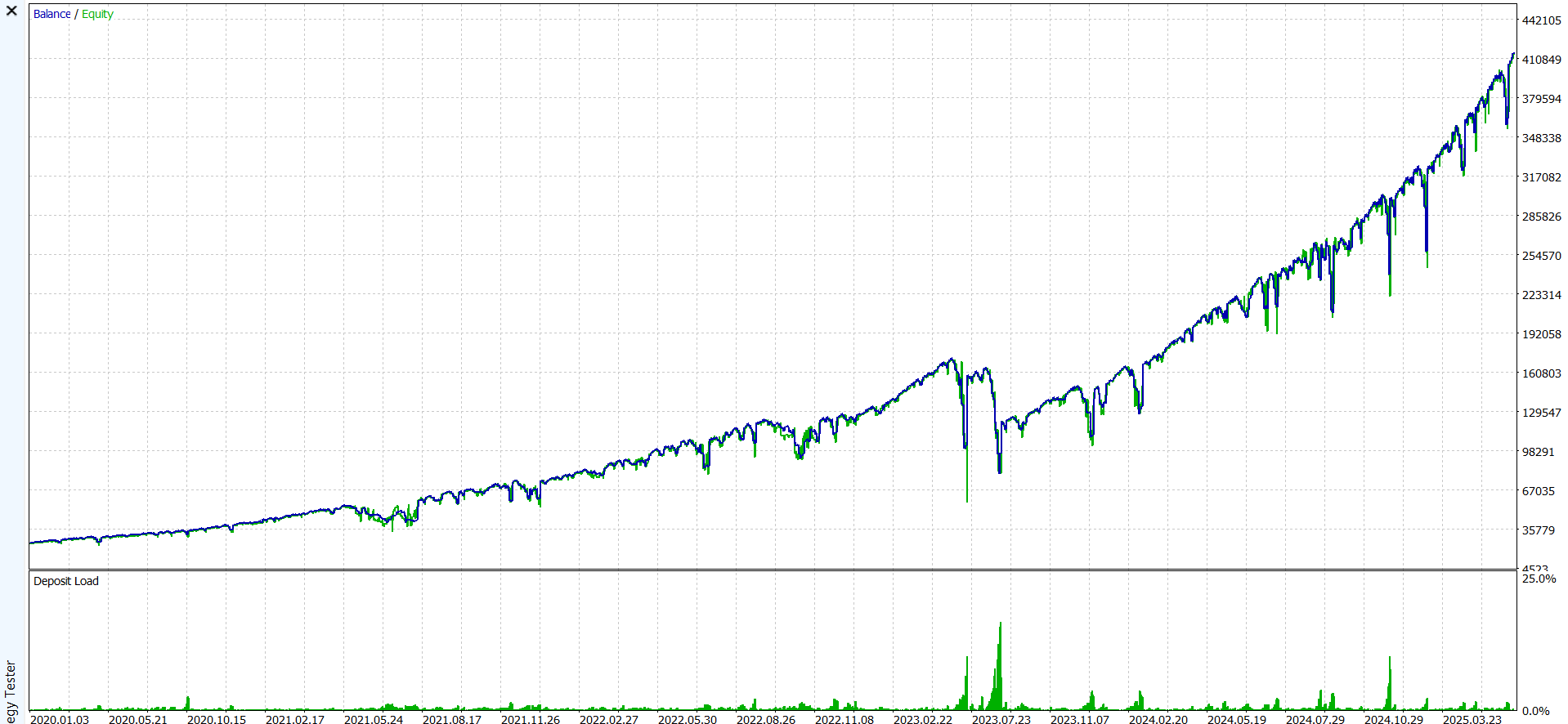

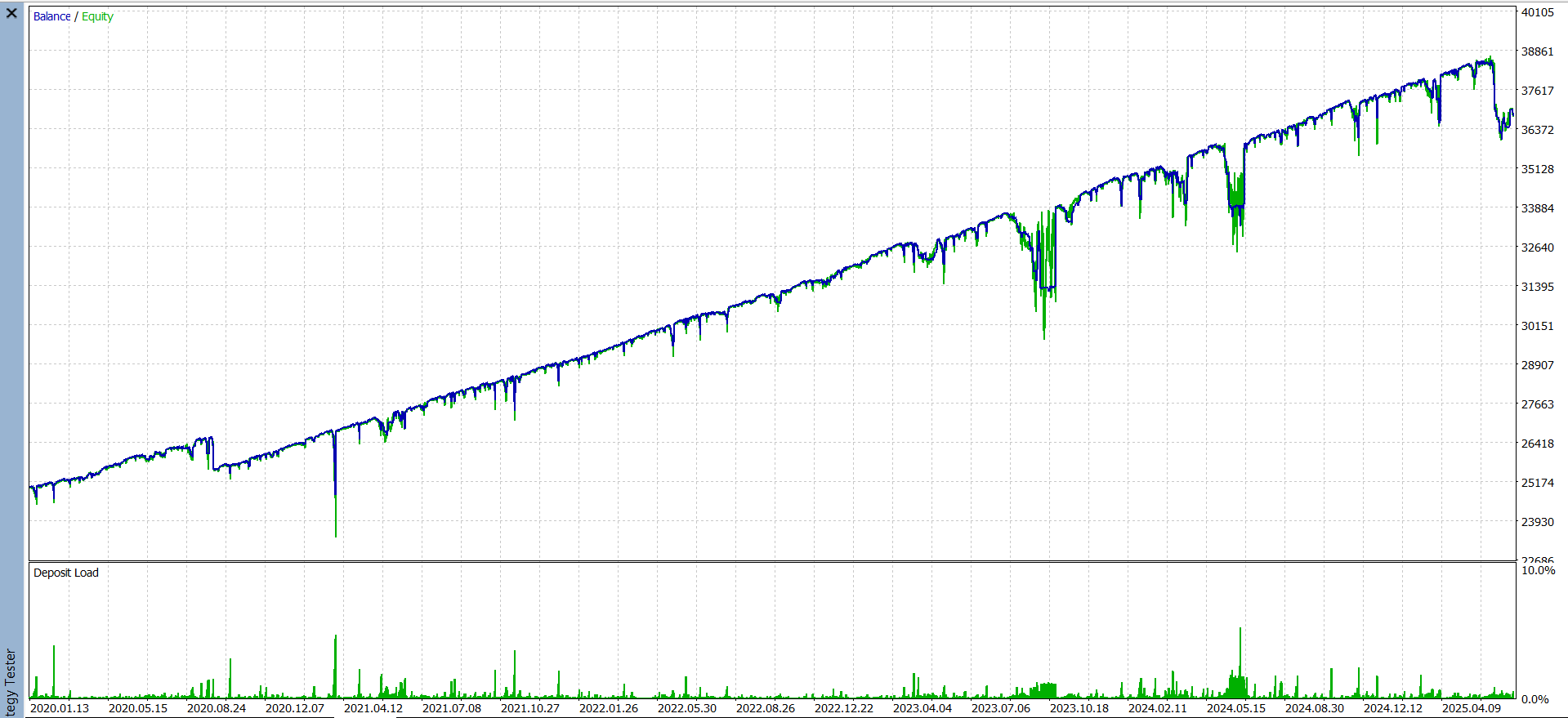

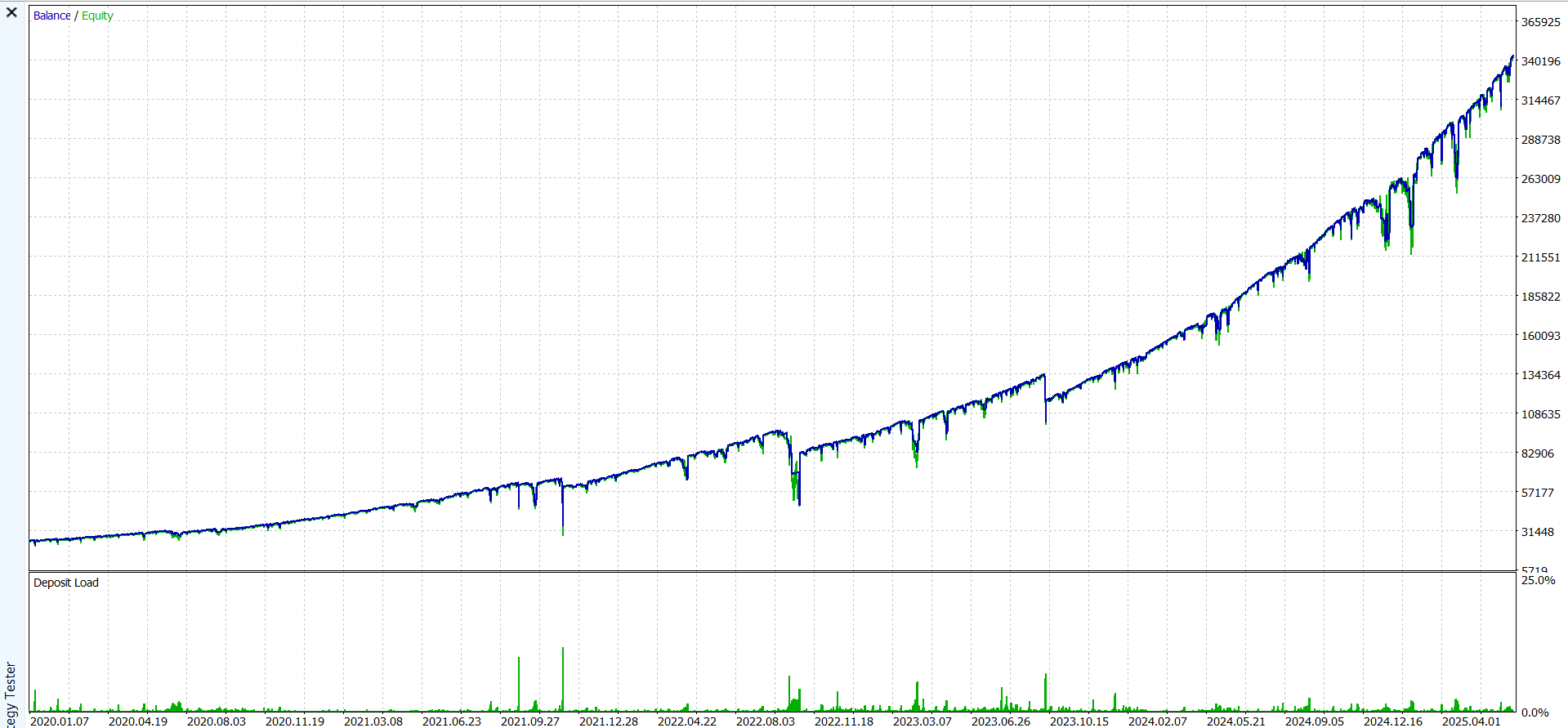

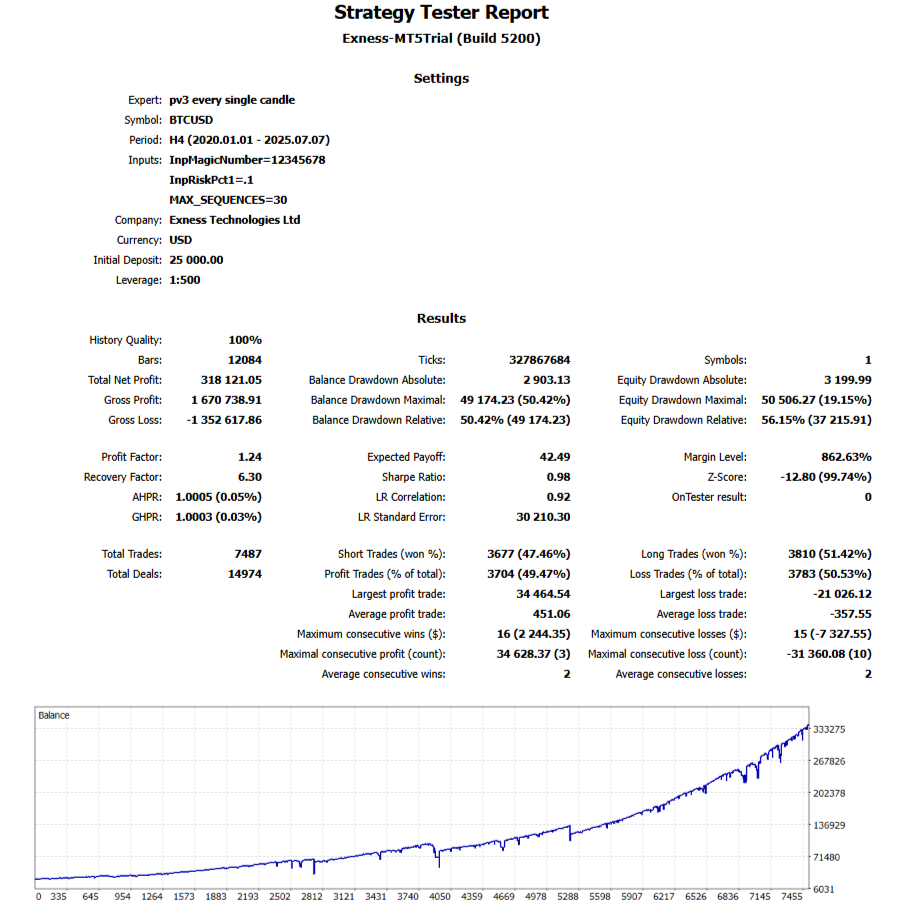

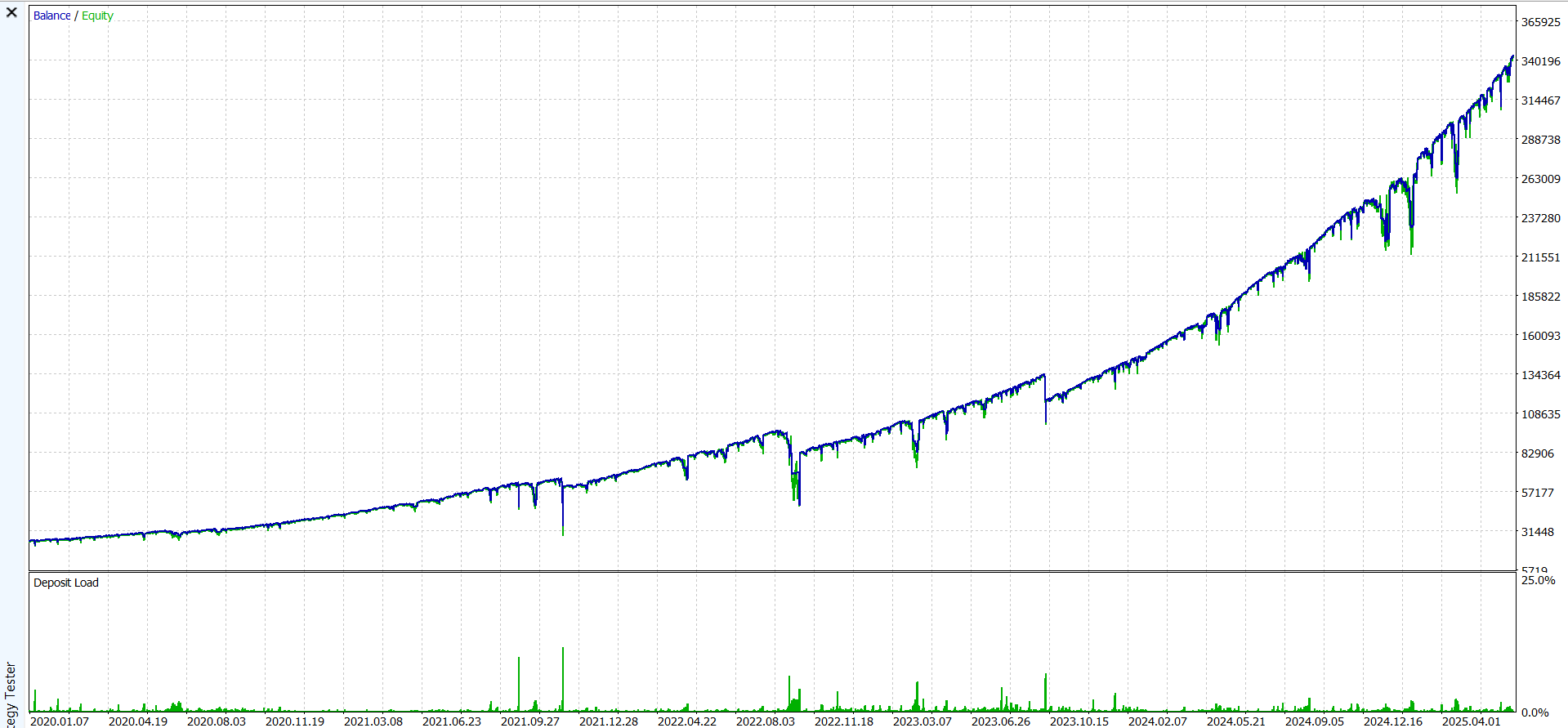

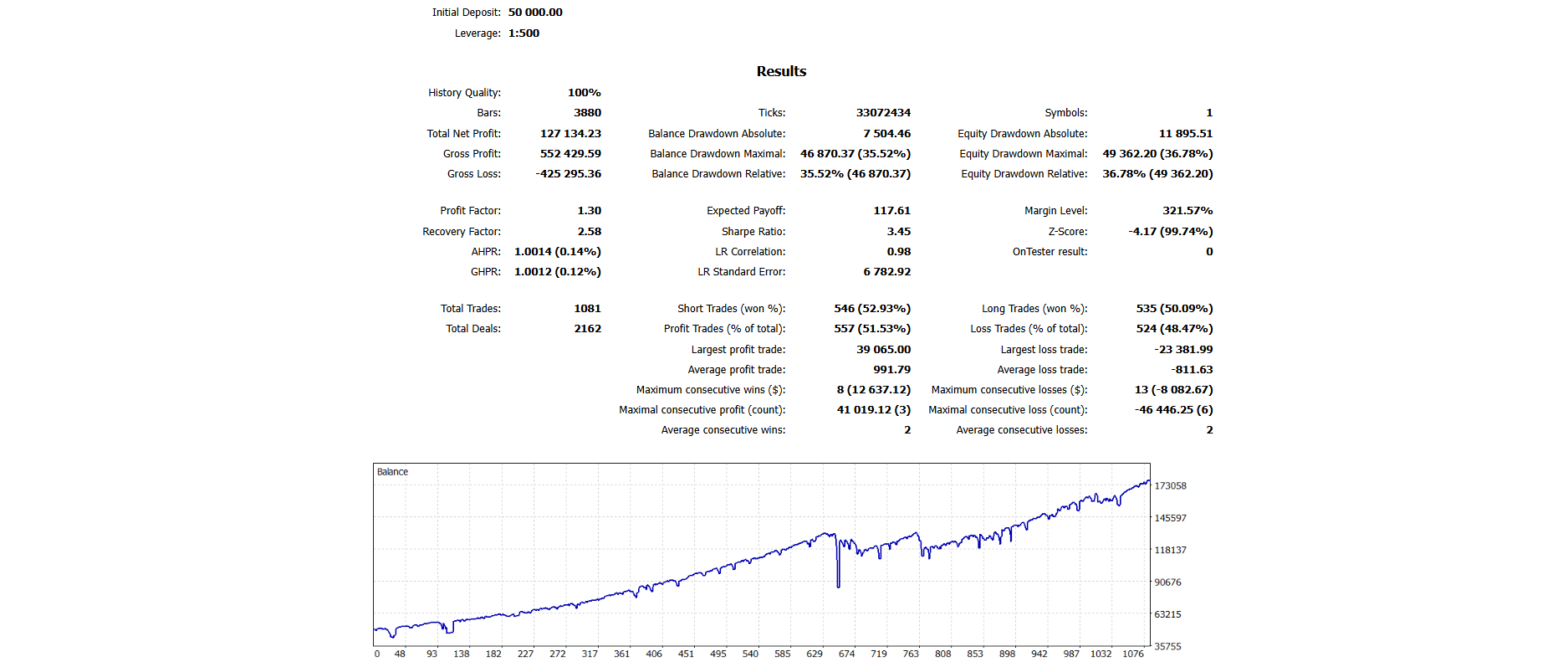

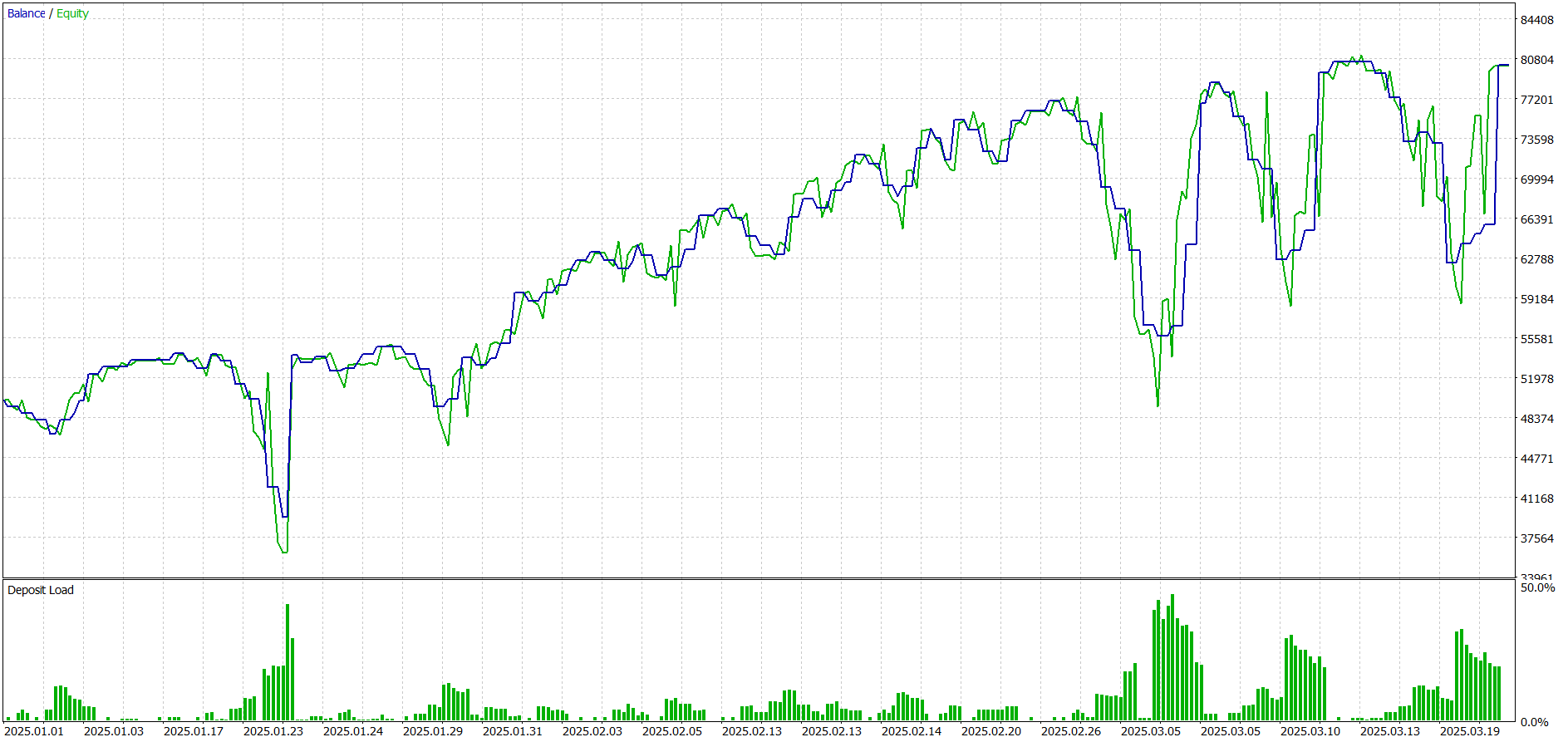

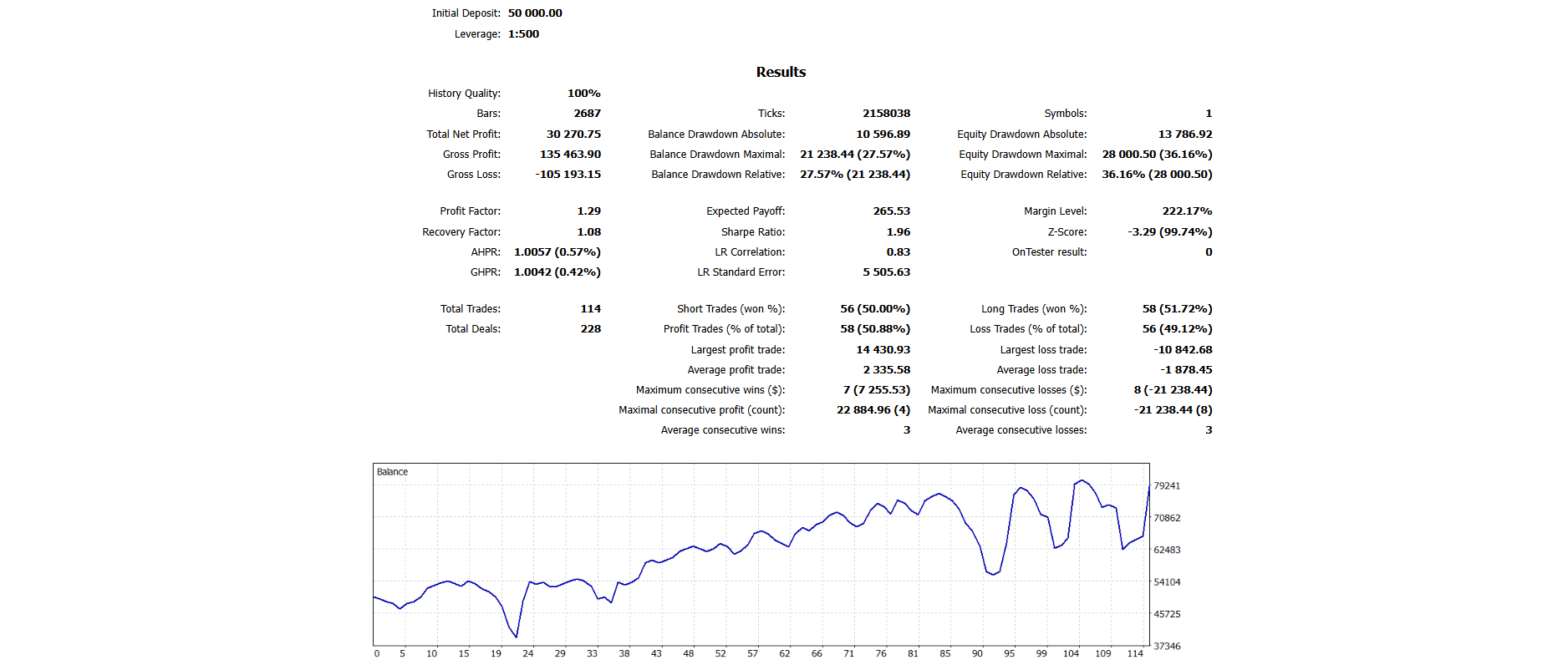

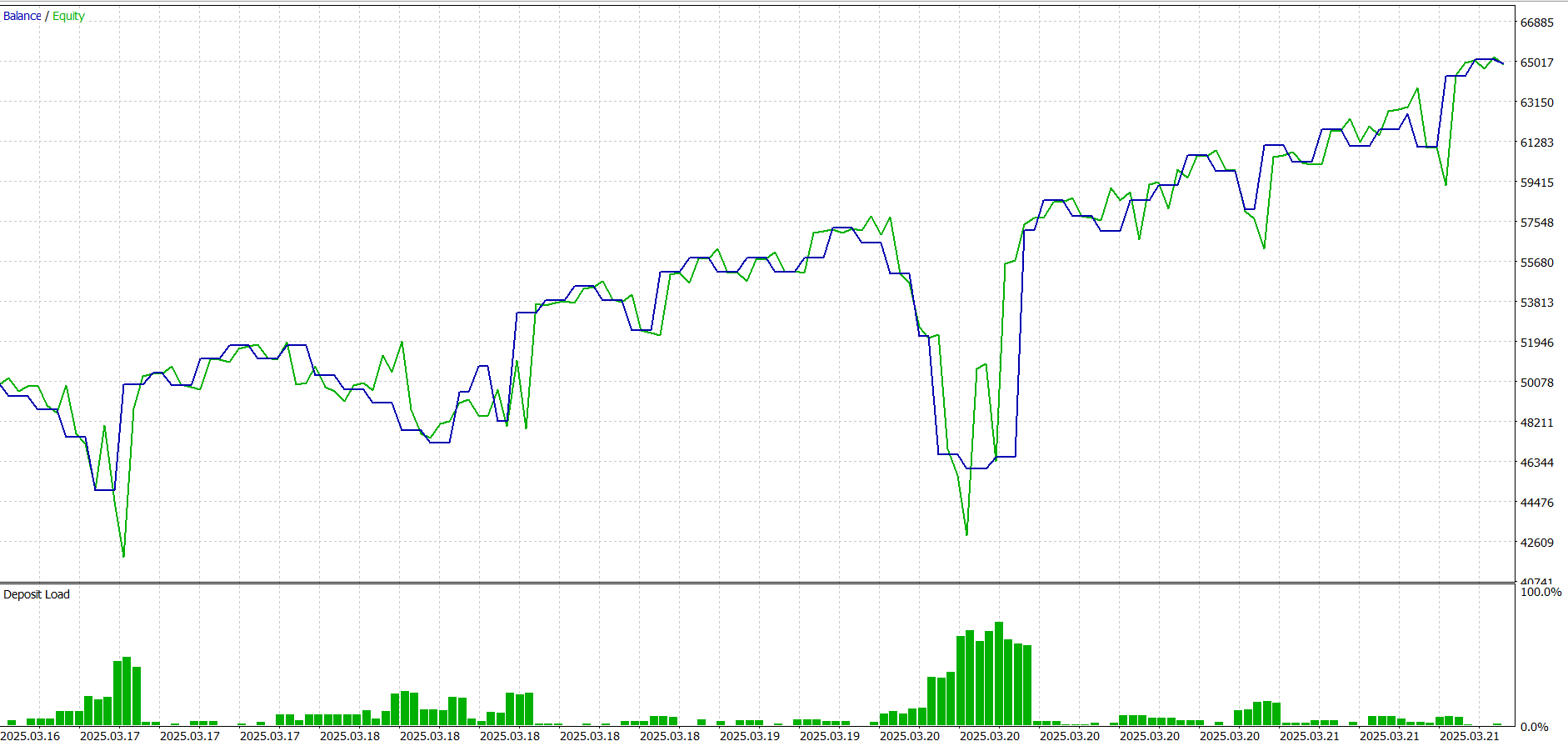

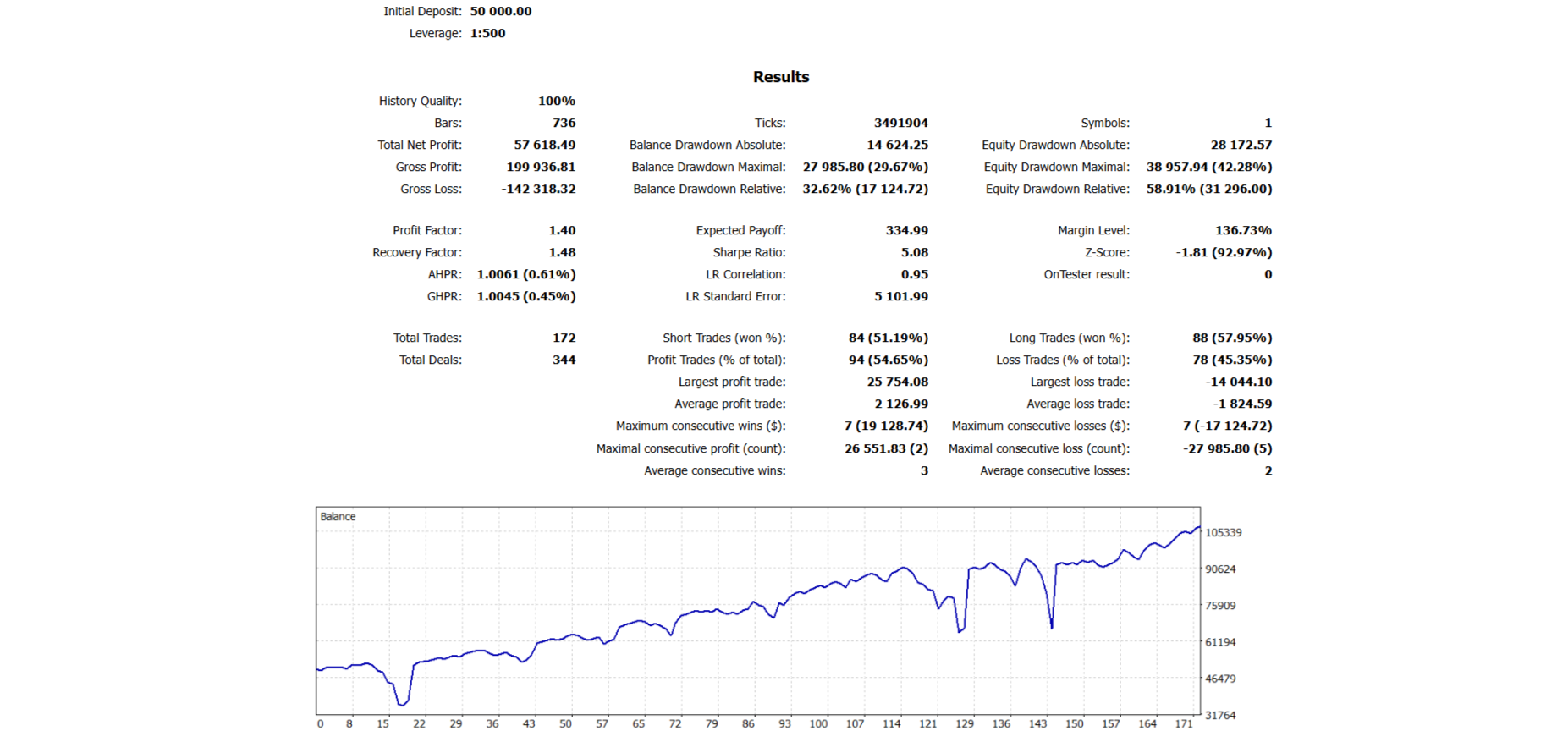

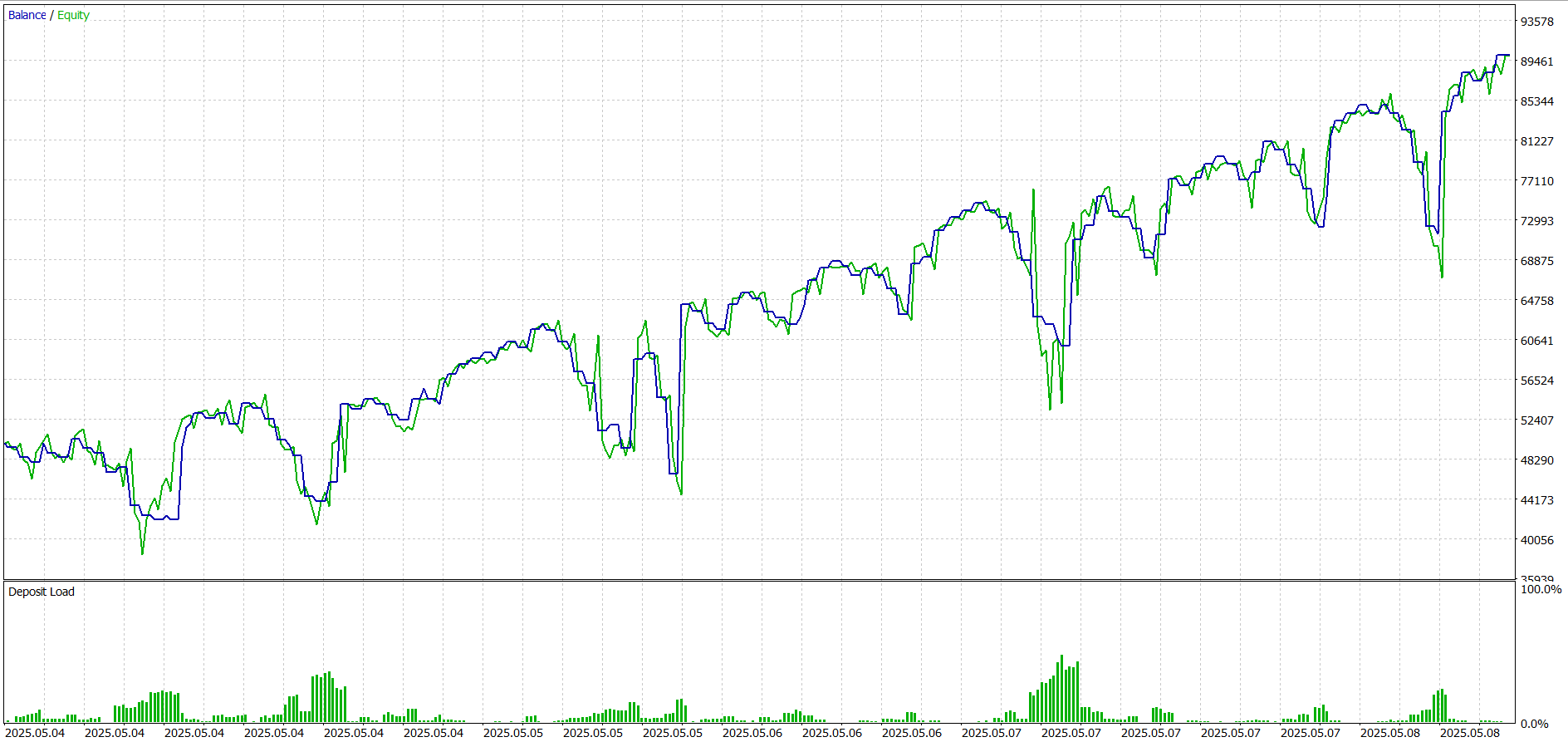

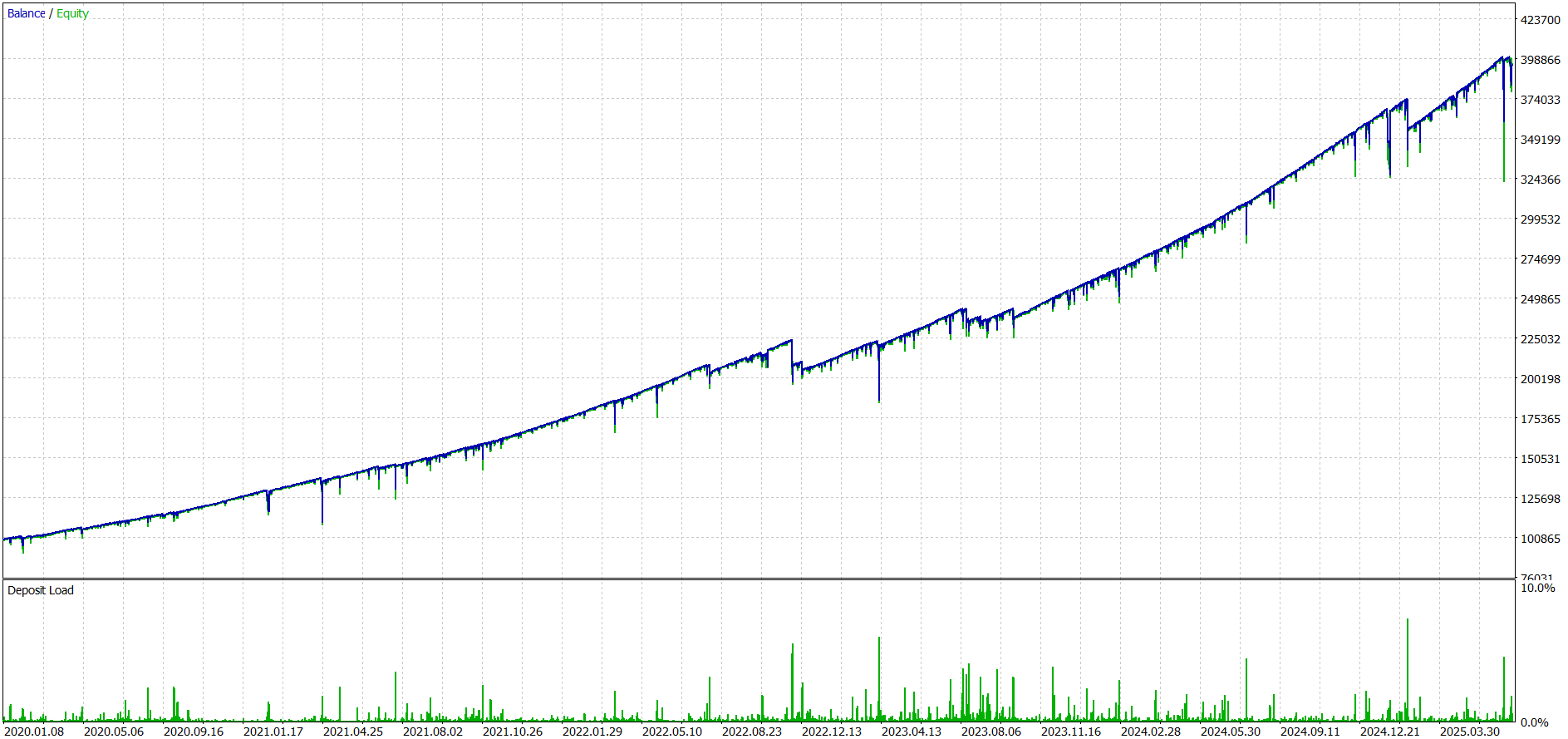

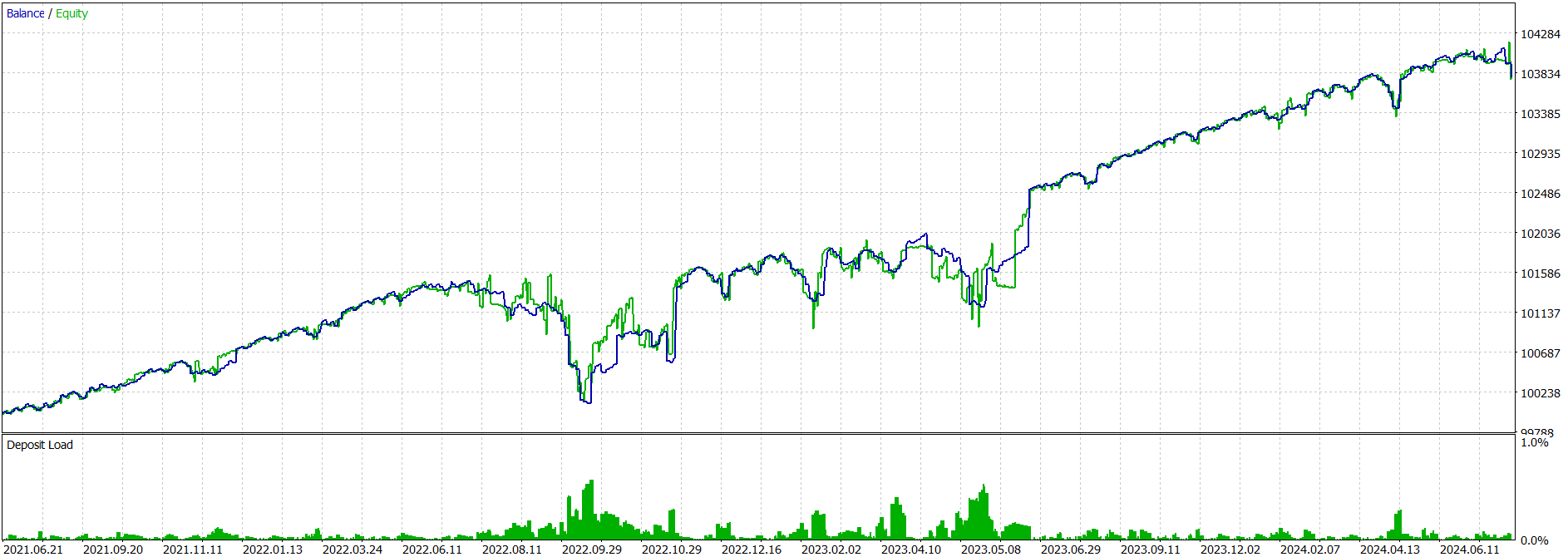

AUGUST 11TH, 2025 | SMOOTHER CURVE BEHAVIOR

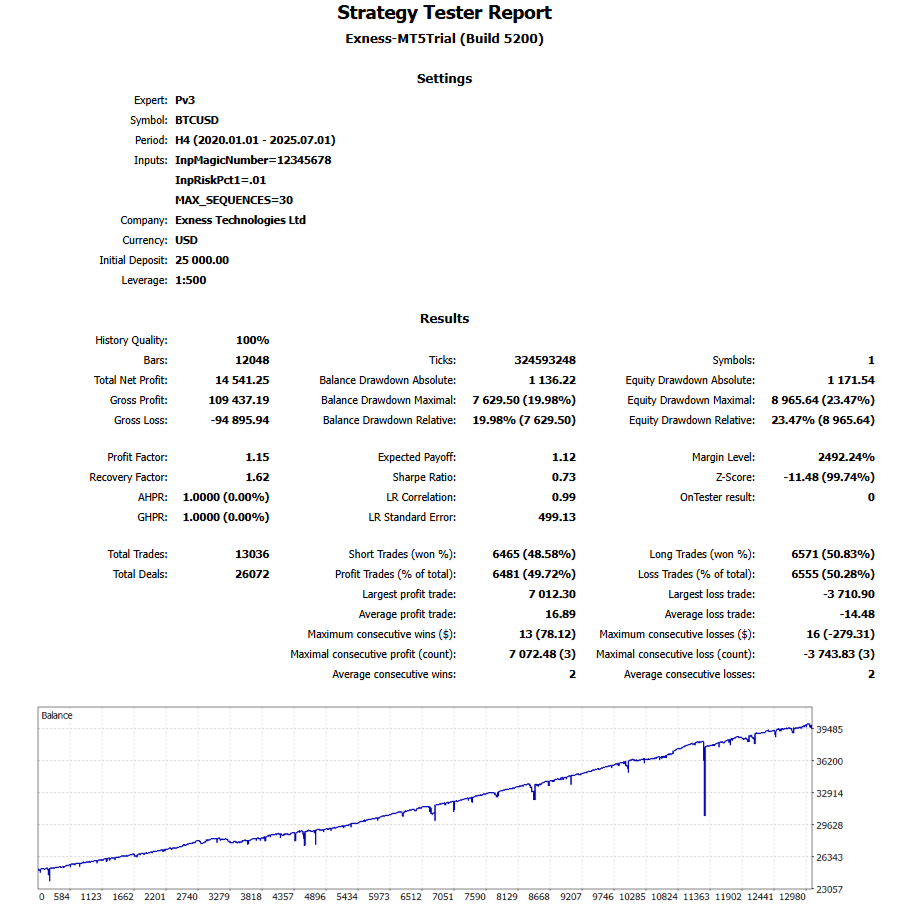

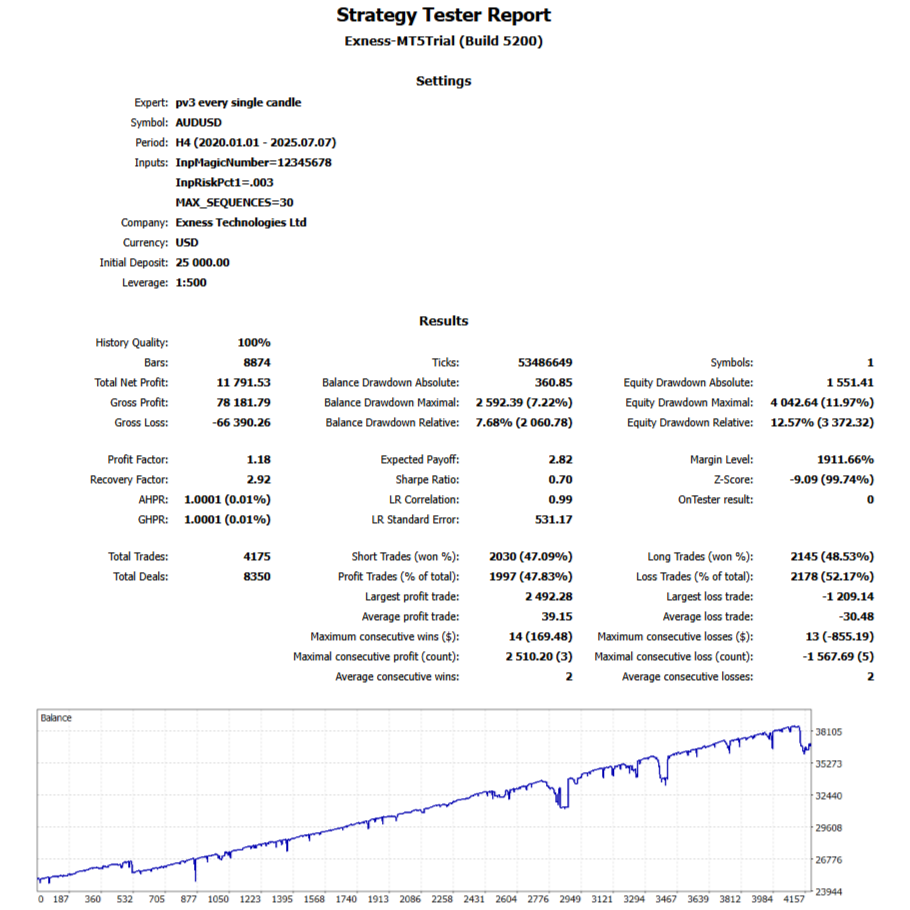

Dev notes: Minimal risk was used to solely view reduced drawdown volatility.

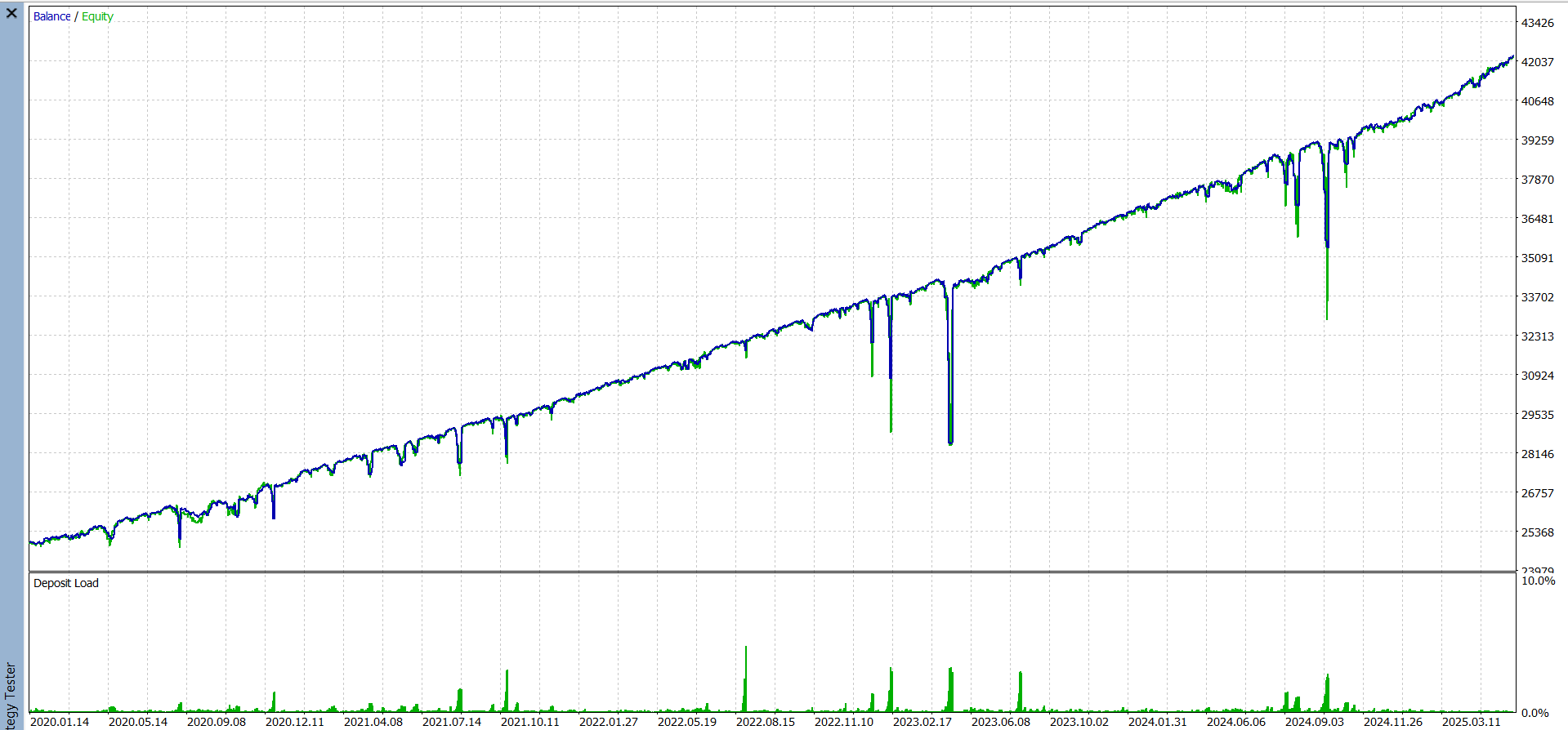

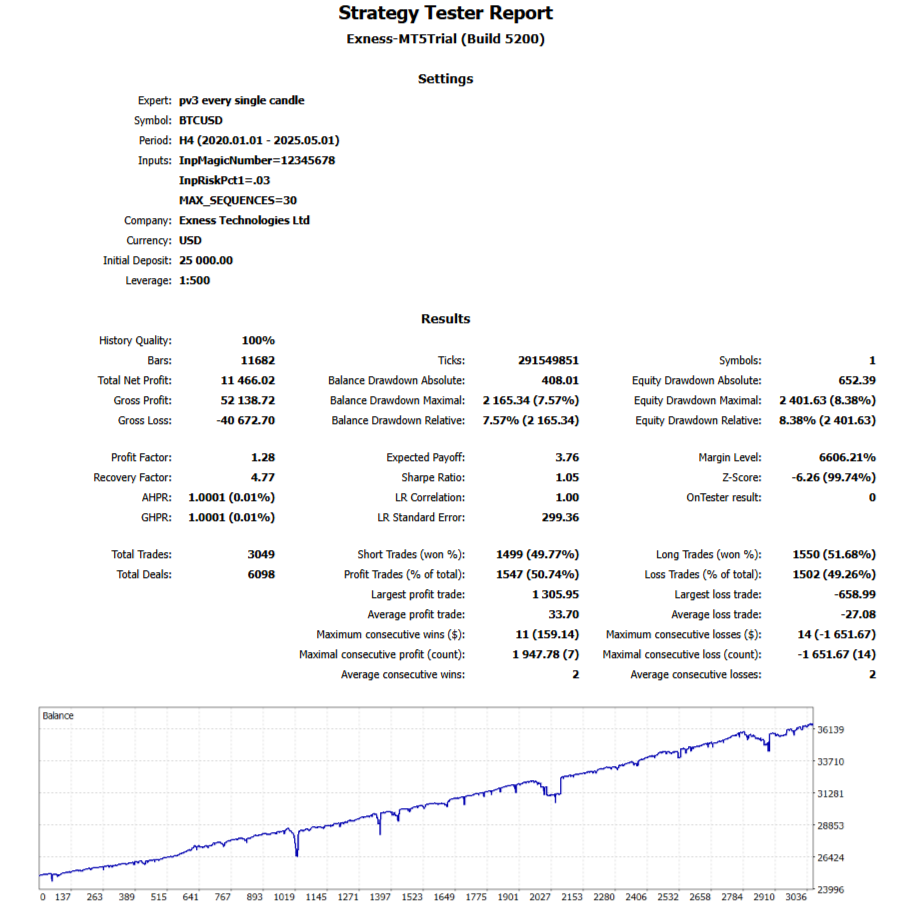

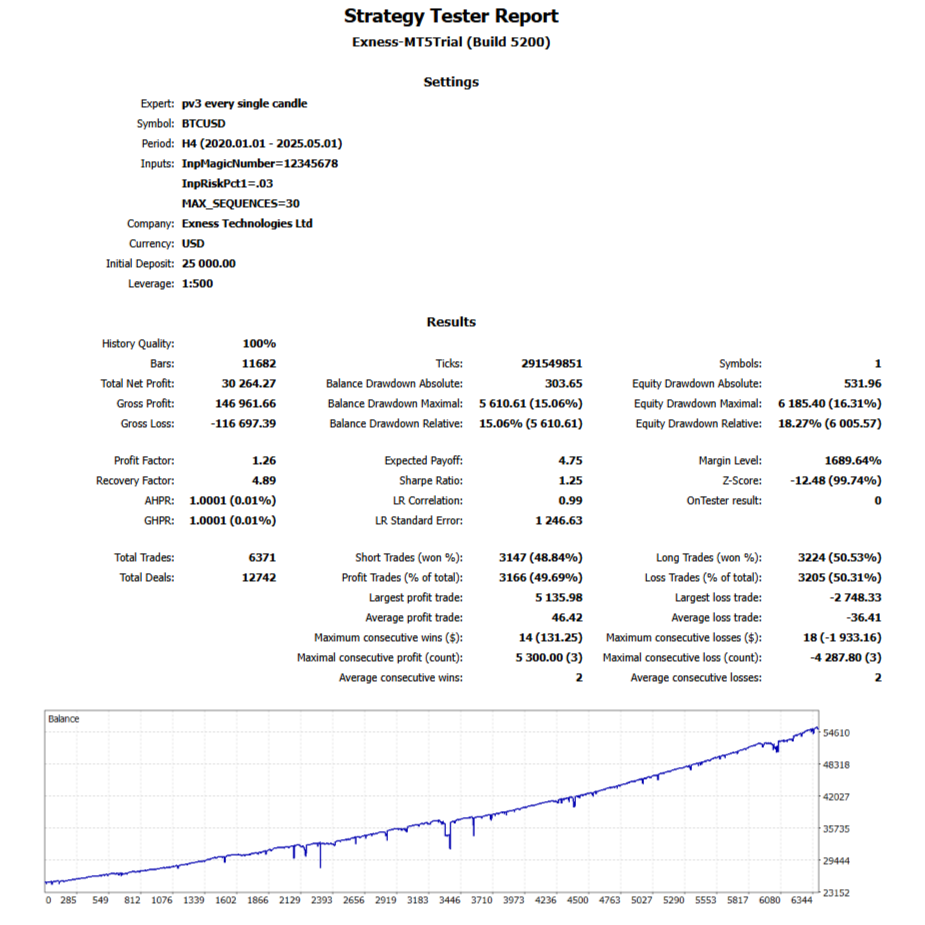

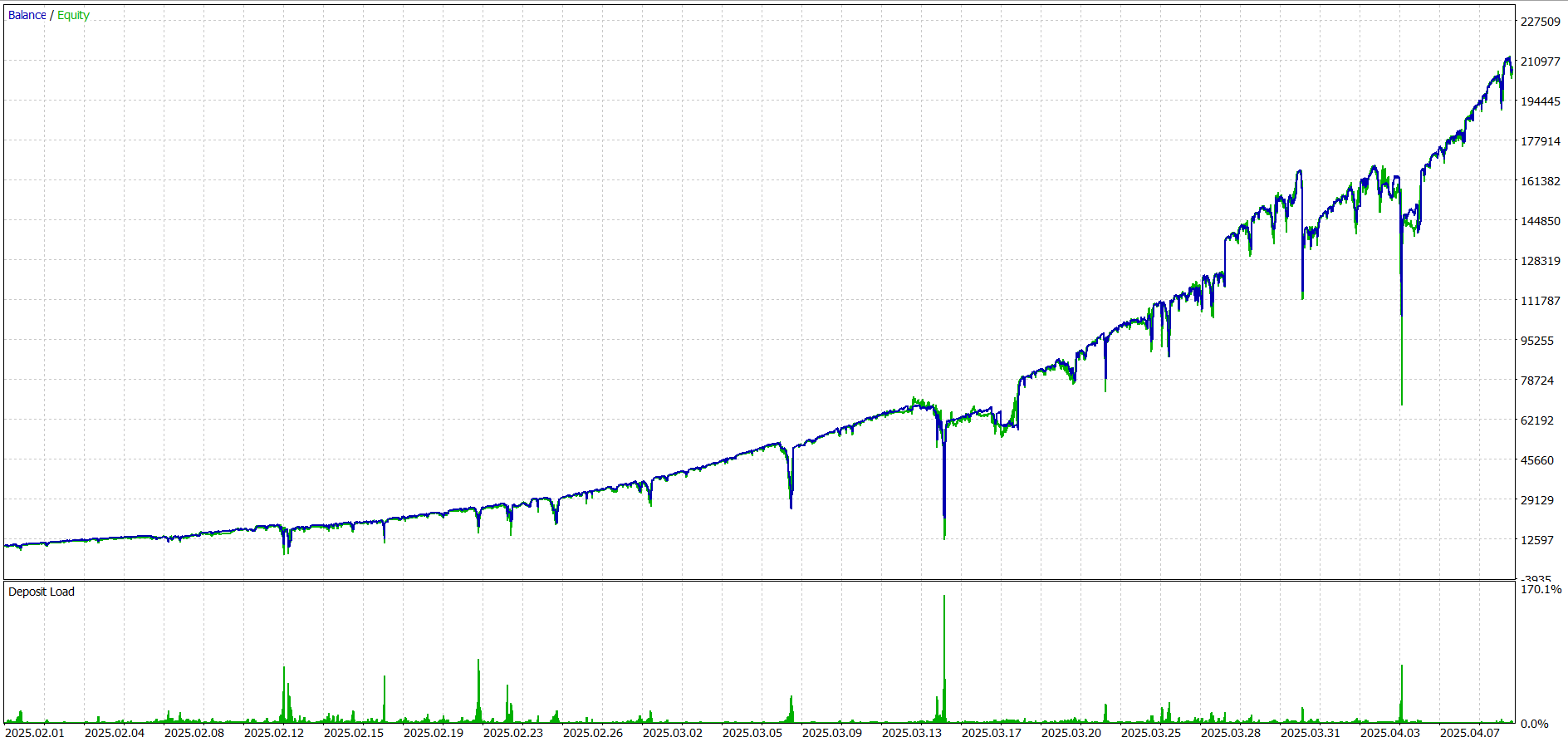

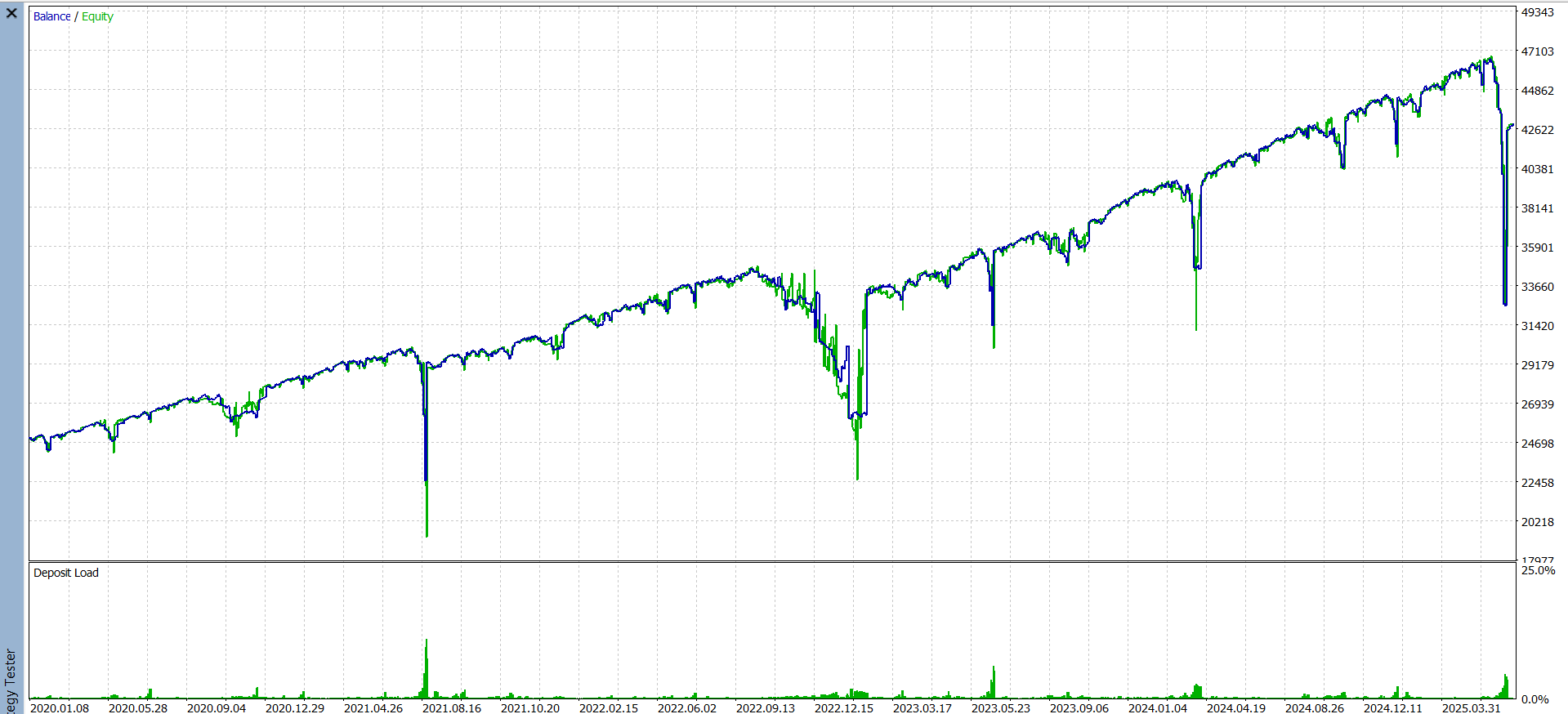

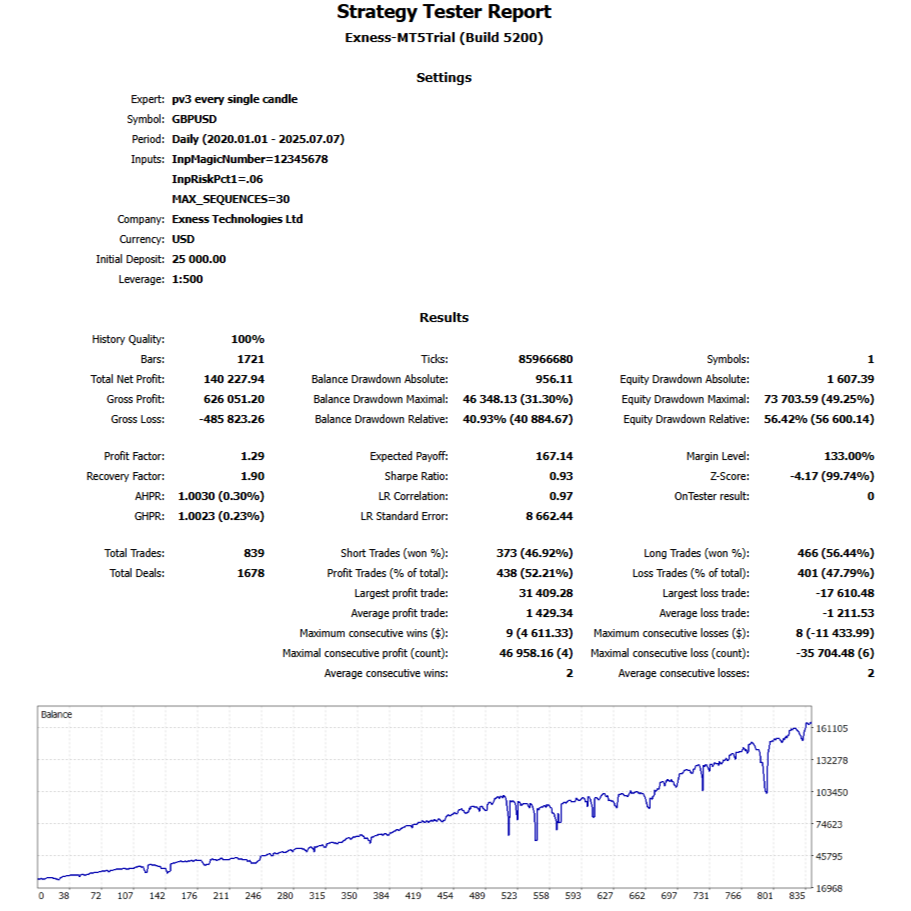

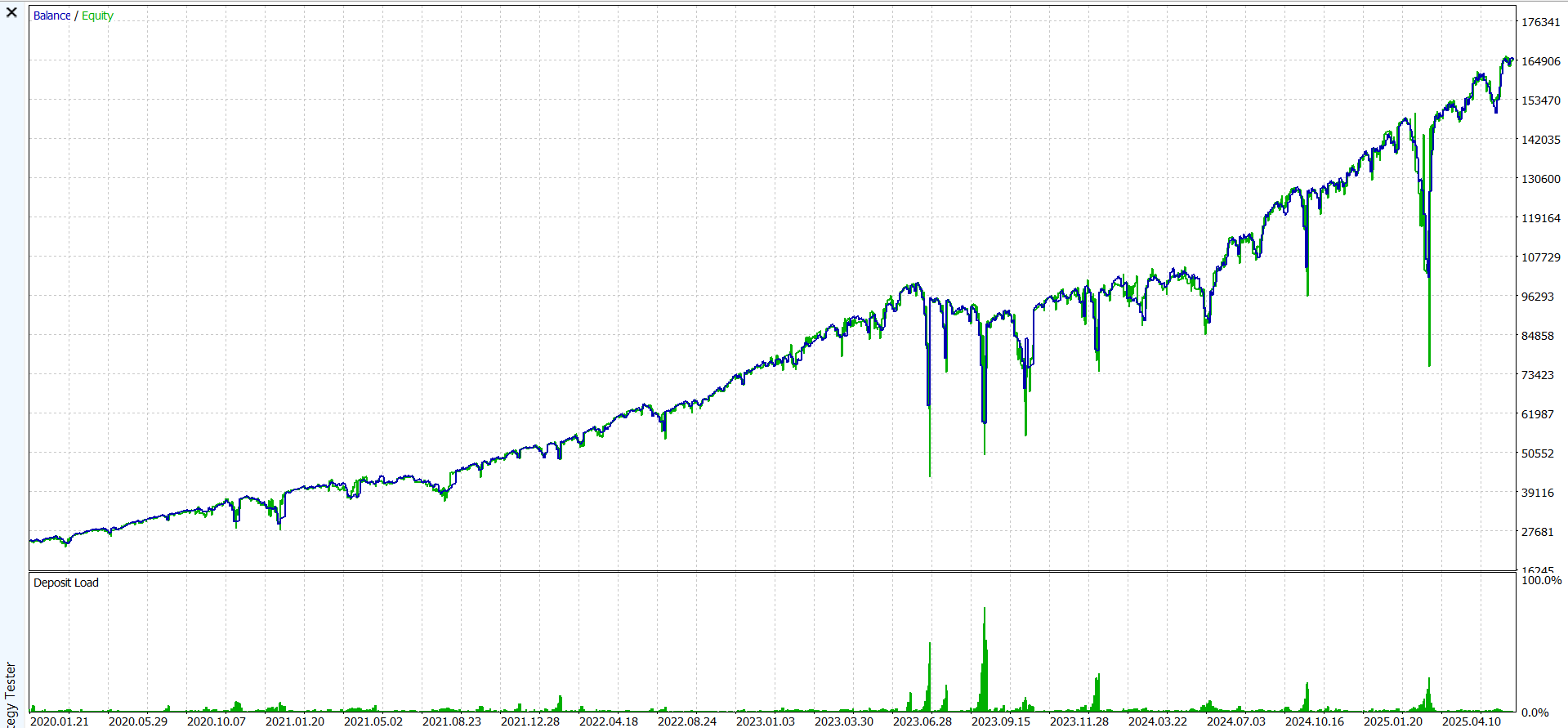

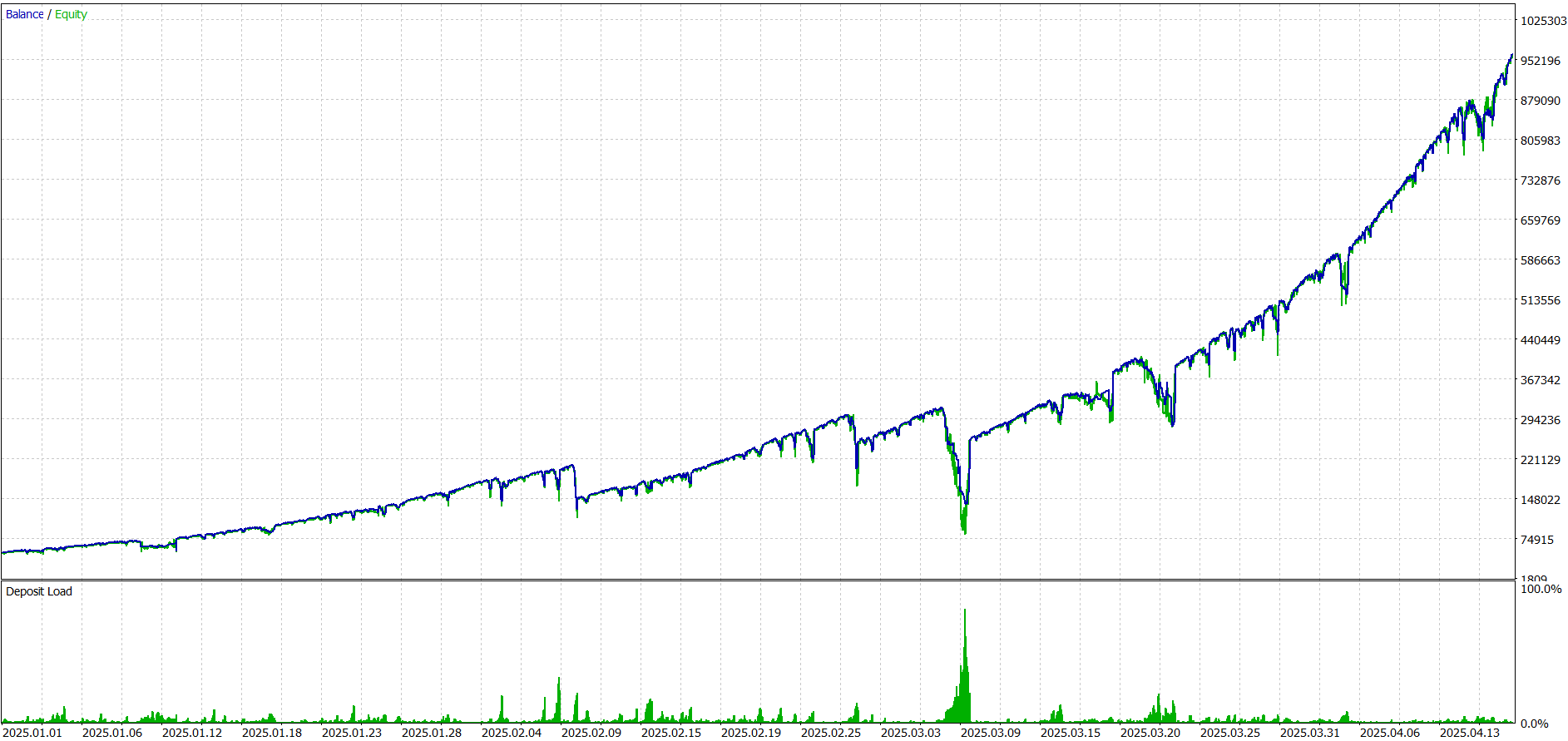

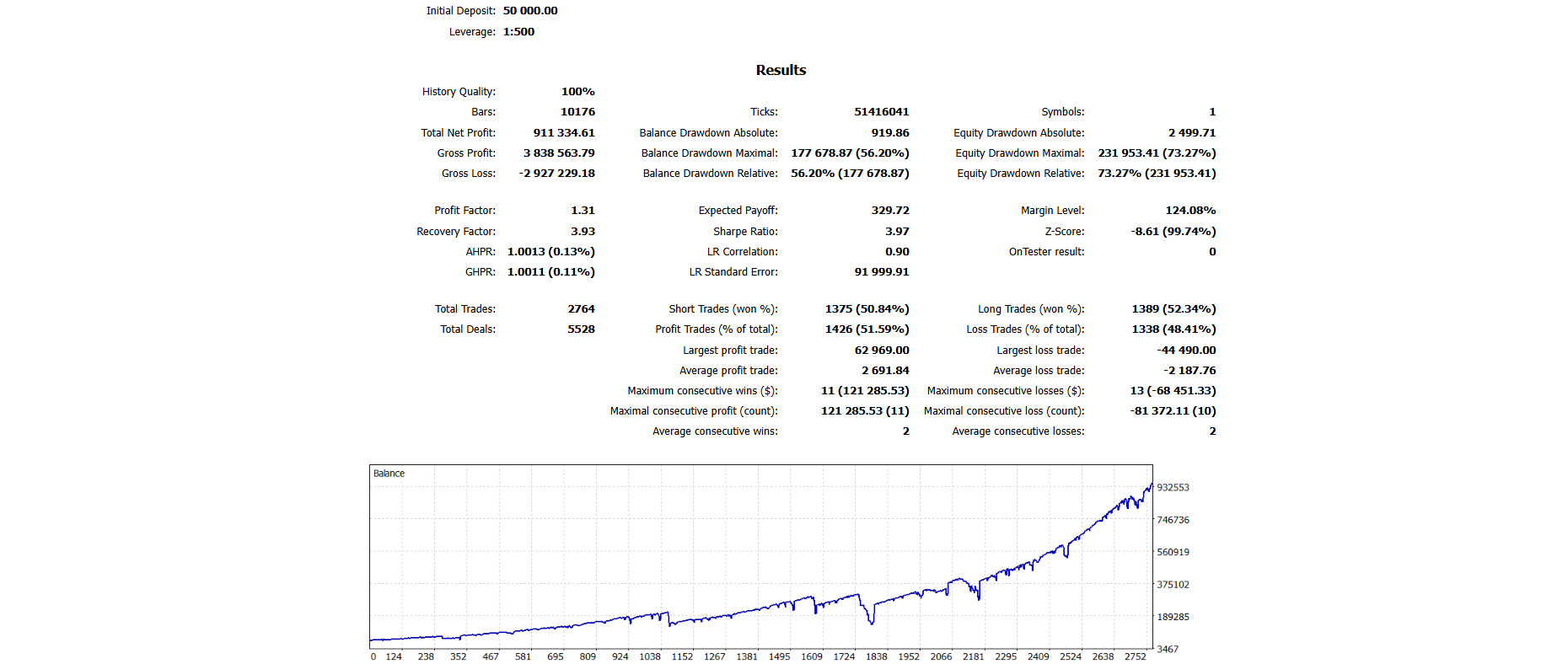

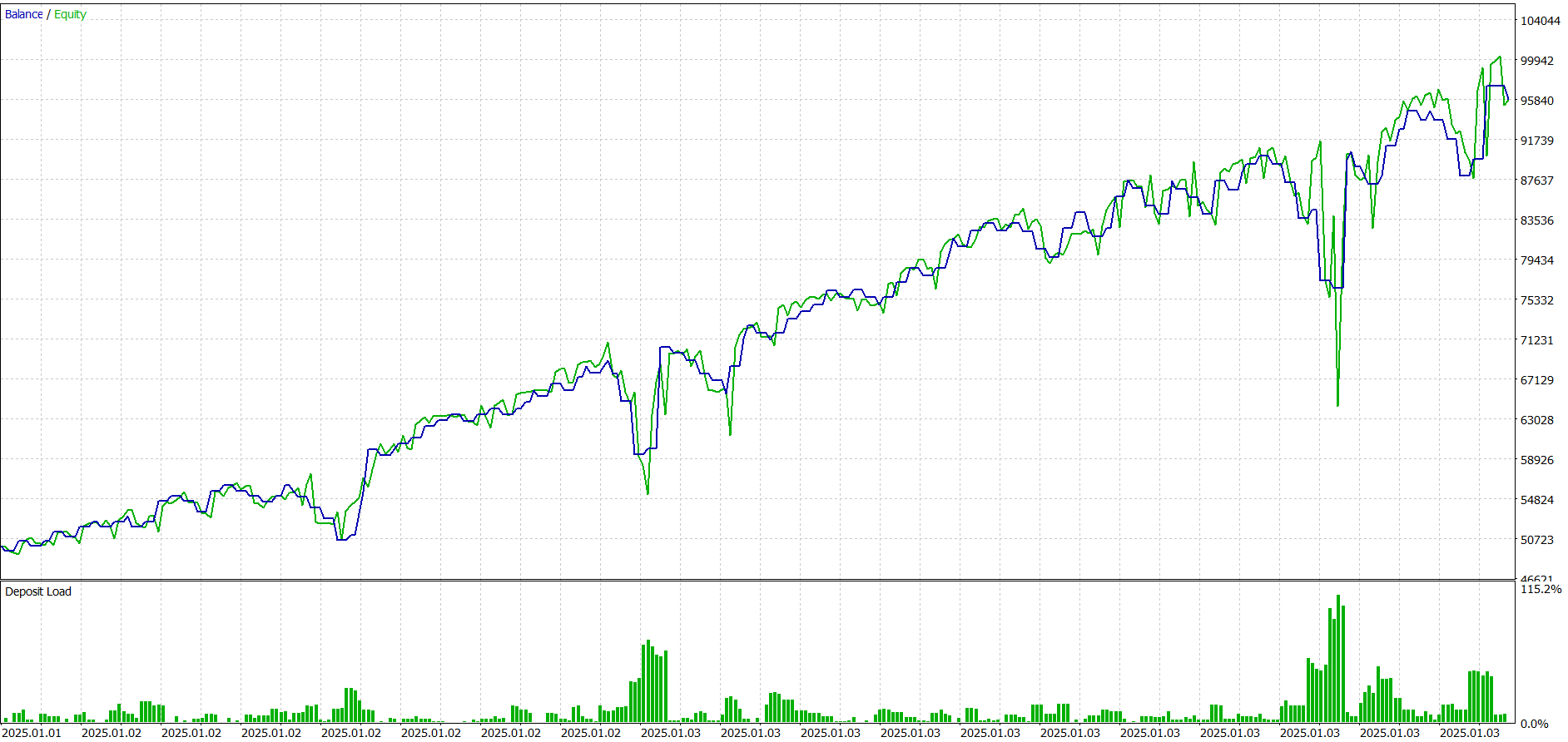

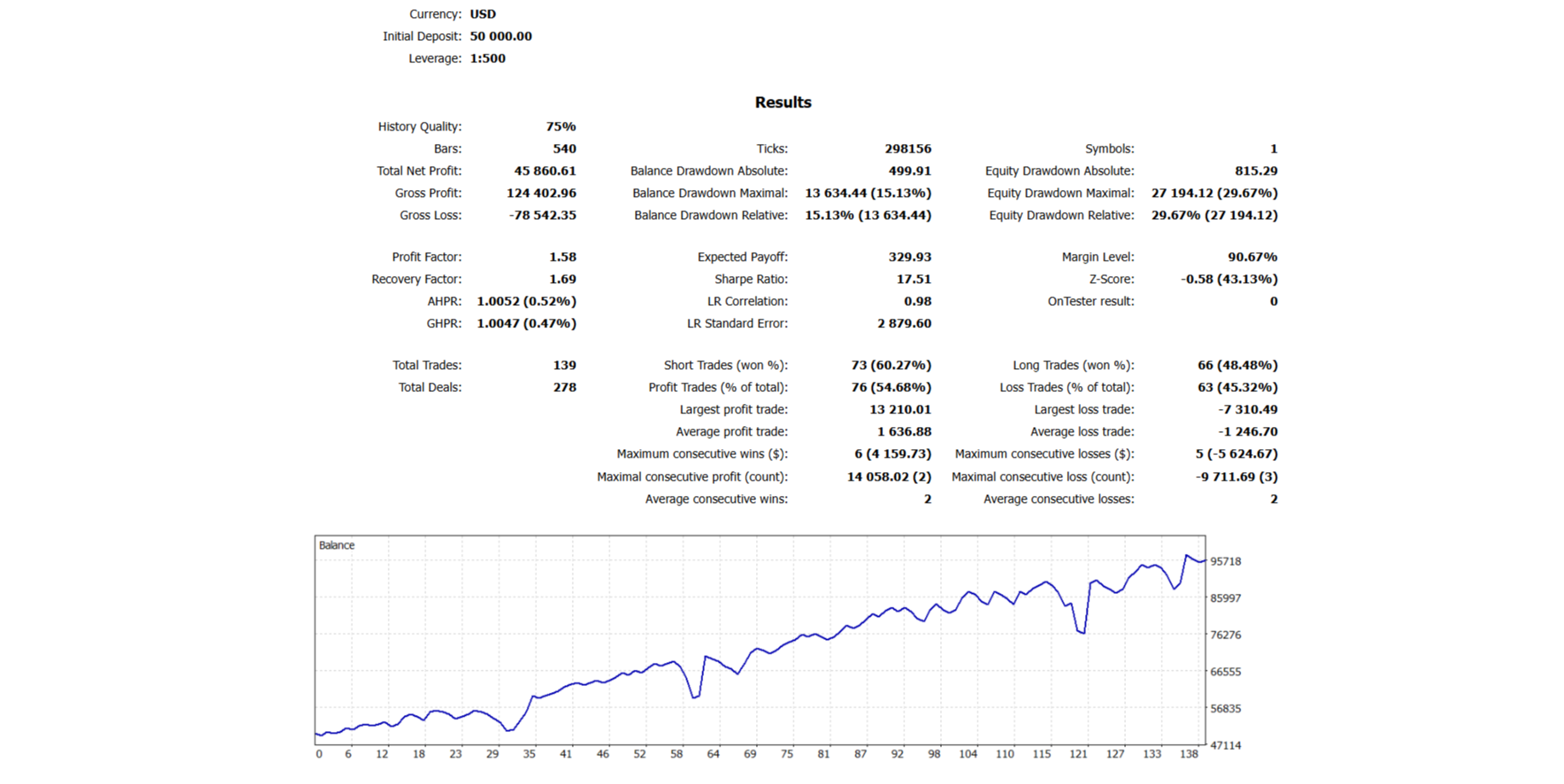

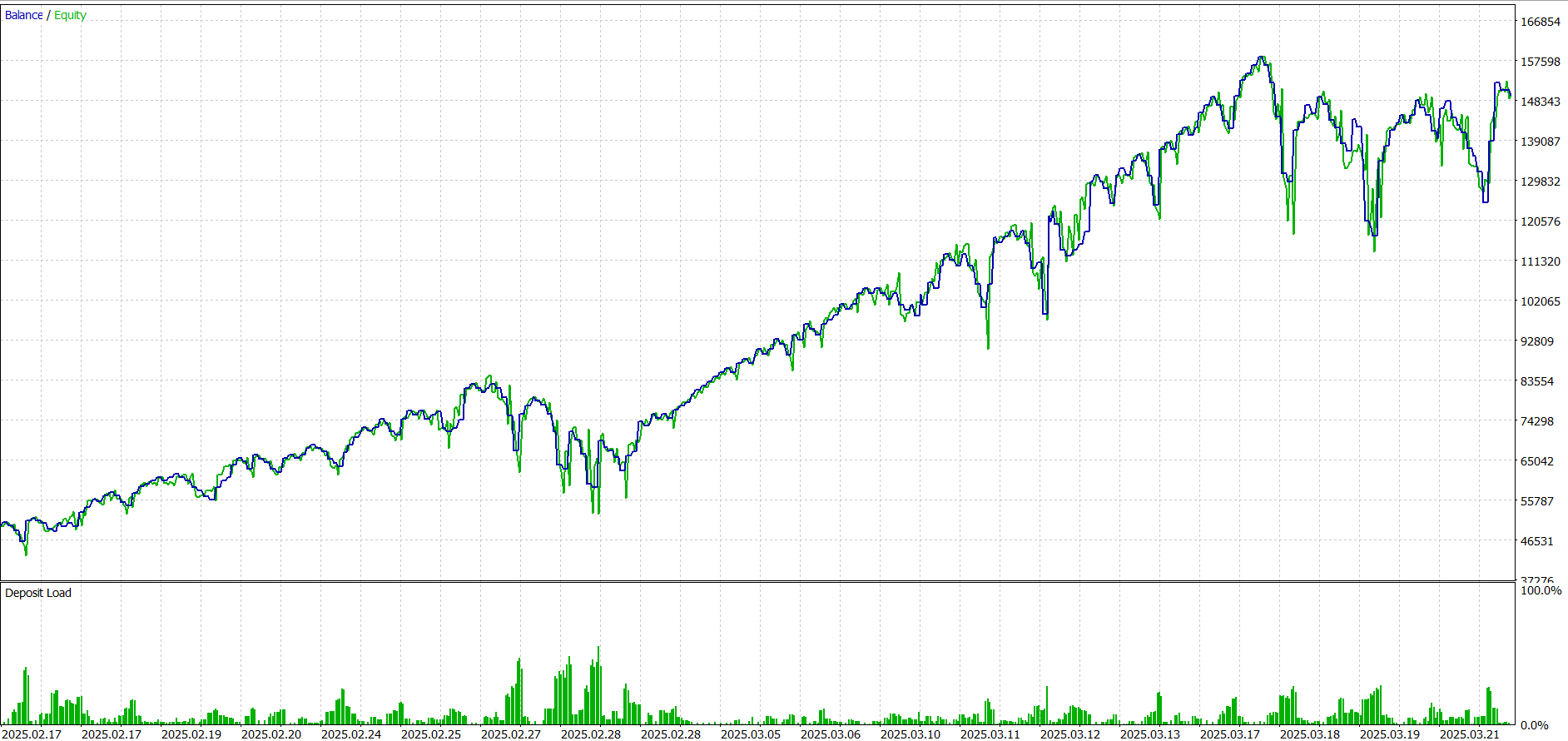

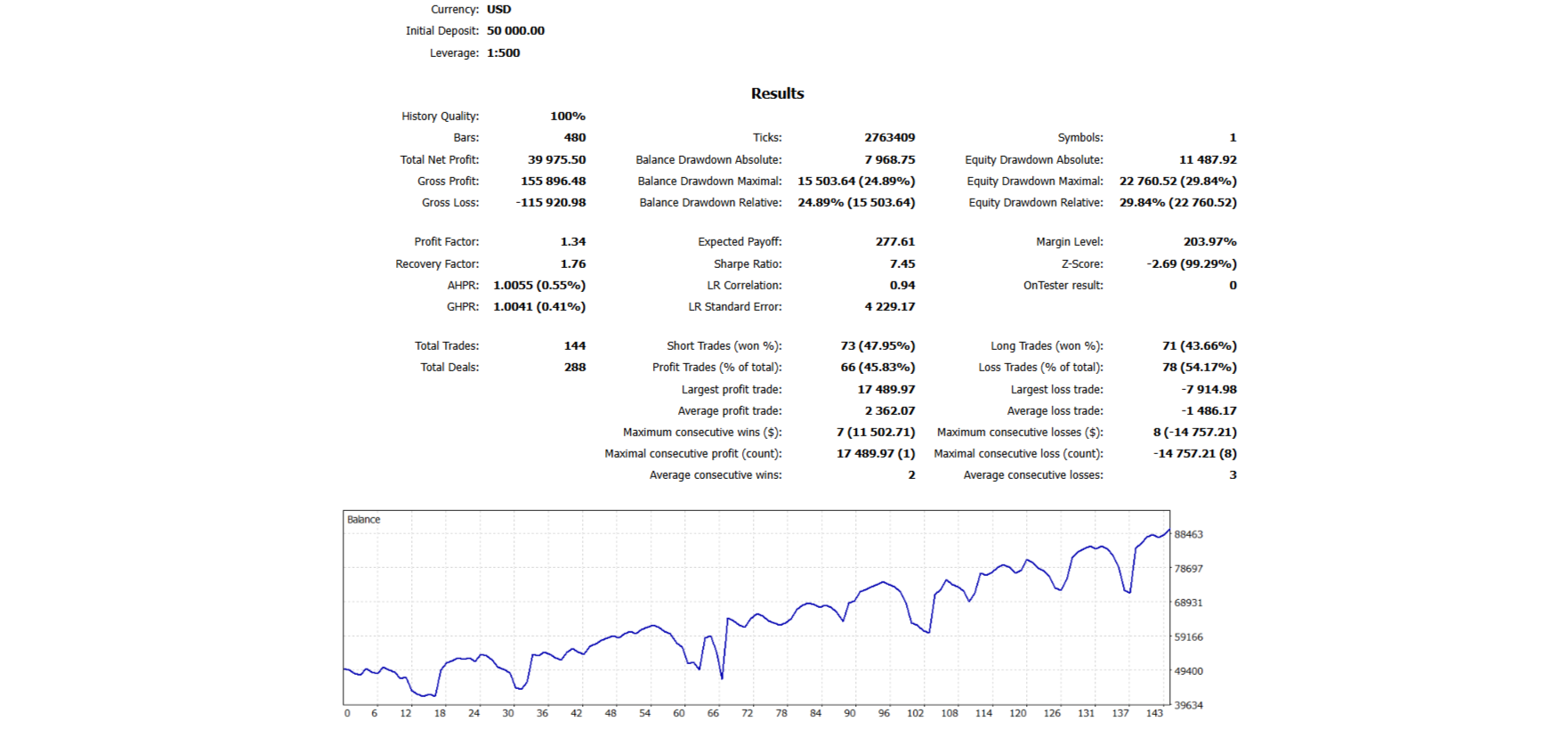

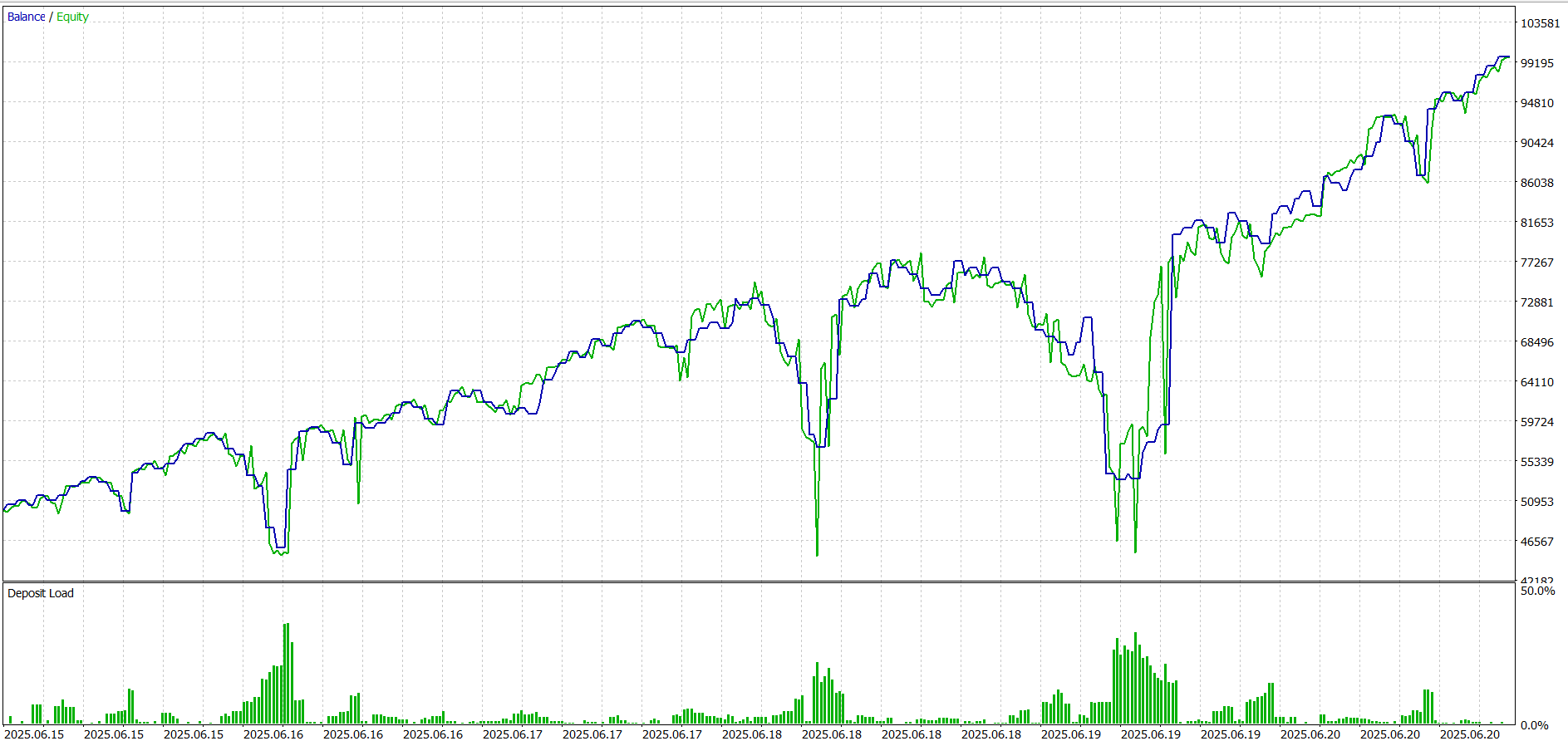

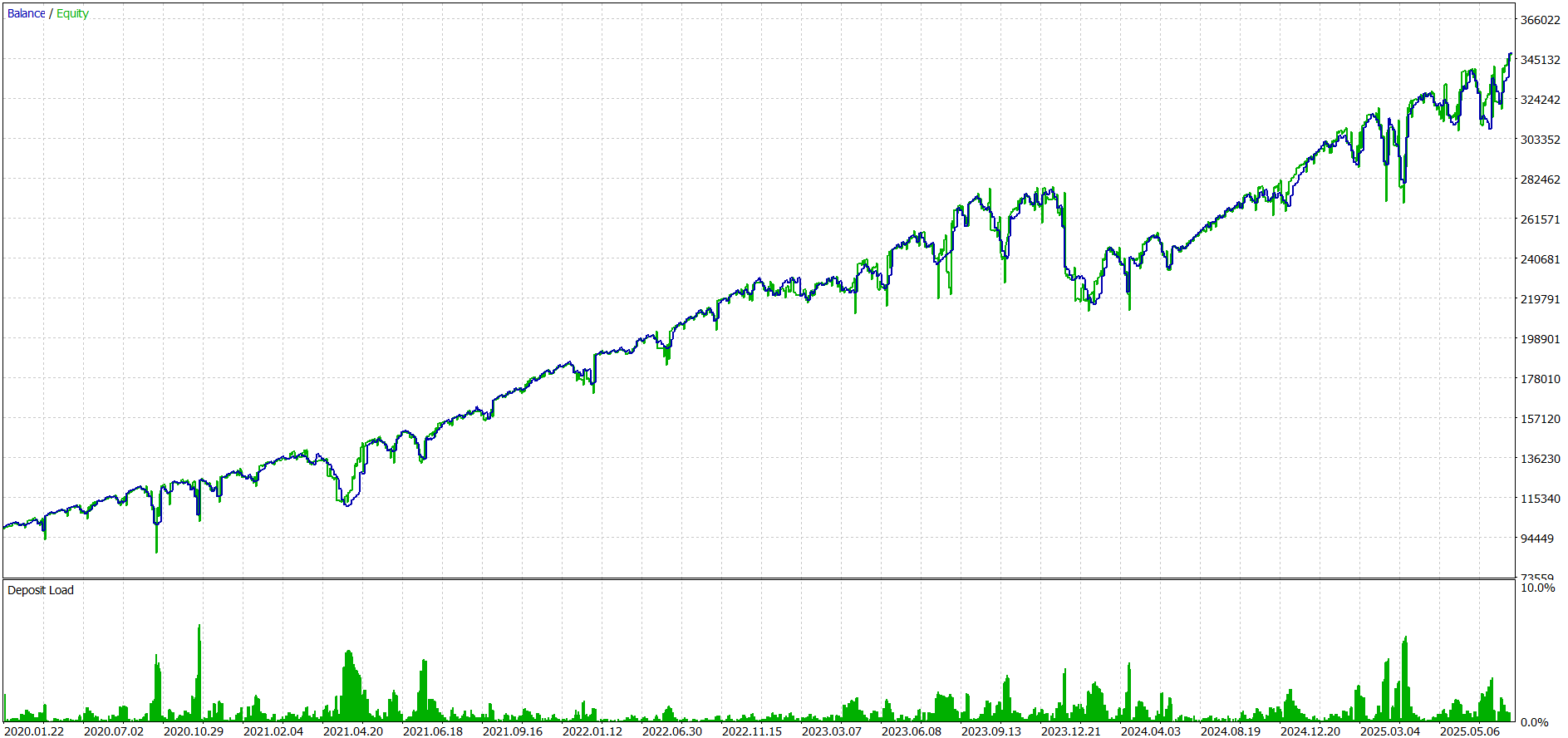

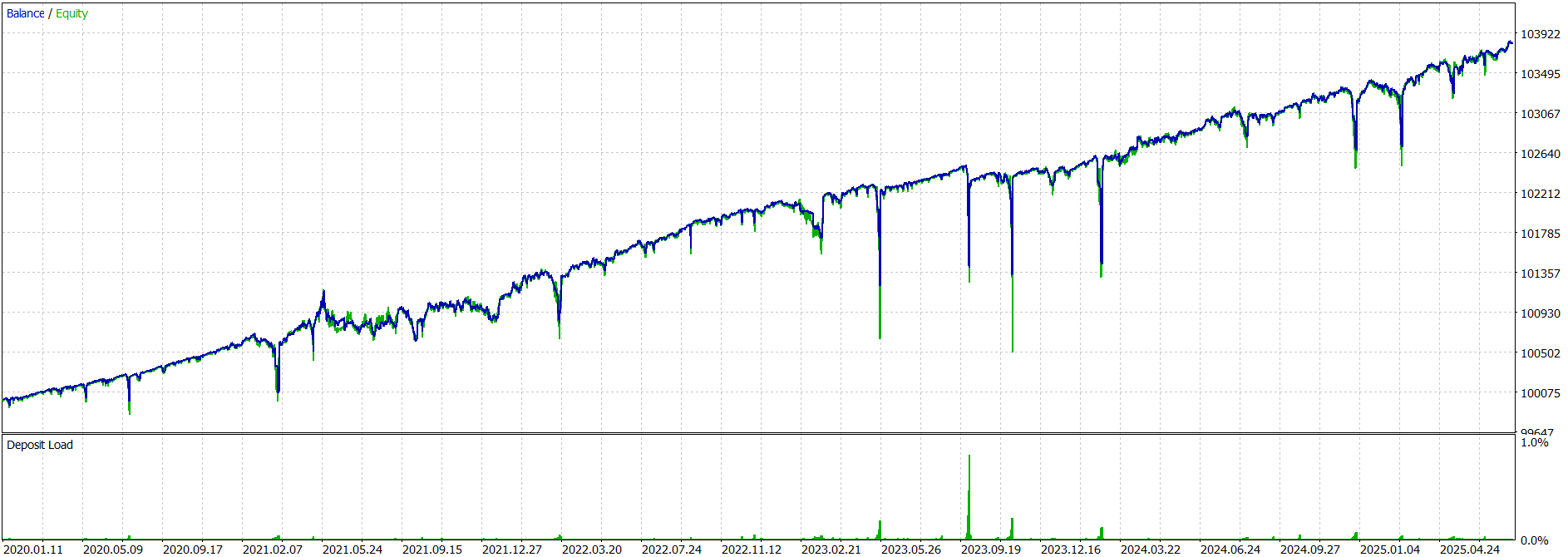

AUGUST 19TH, 2025 | PARABOLIC RETURNS

Dev notes: Semi-maximal risk was used to highlight return potential and gauge capital efficiency.

Upcoming execution models

Introducing our automated trading oracle, "pv3"

Designed to hyperfocus on risk mitigation and decentralized risk stabilization, qs Dev is engineering pv3 to implement risk-based execution models vs price-based/price action-based execution models.

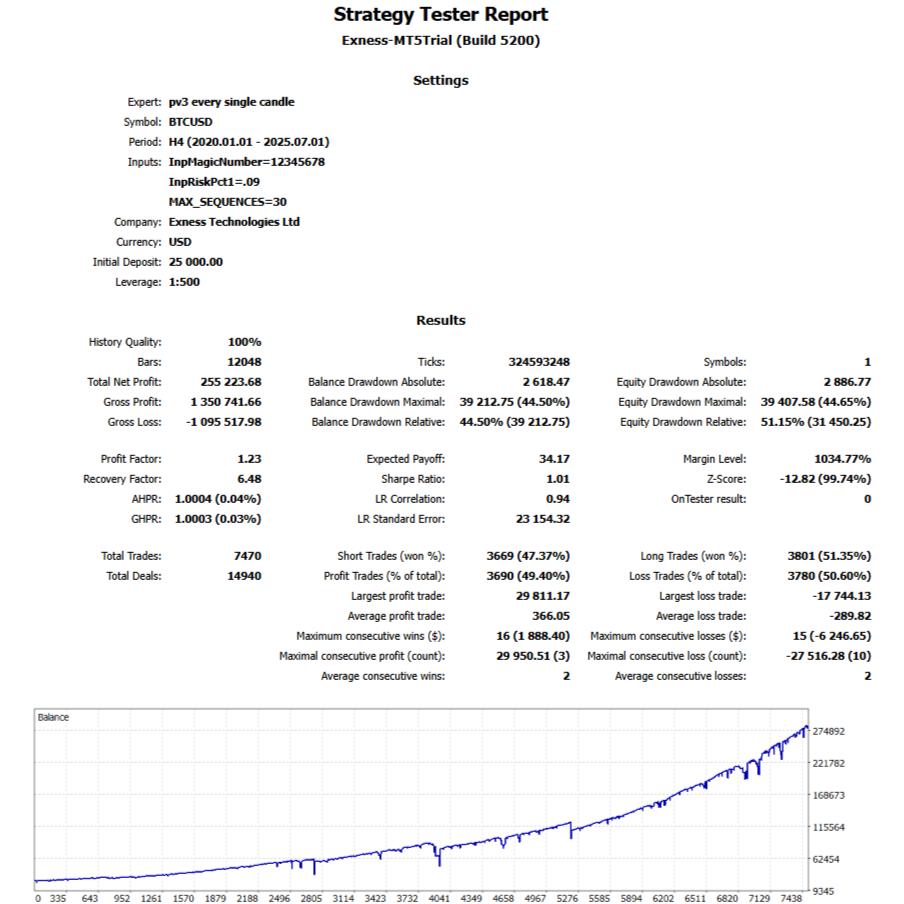

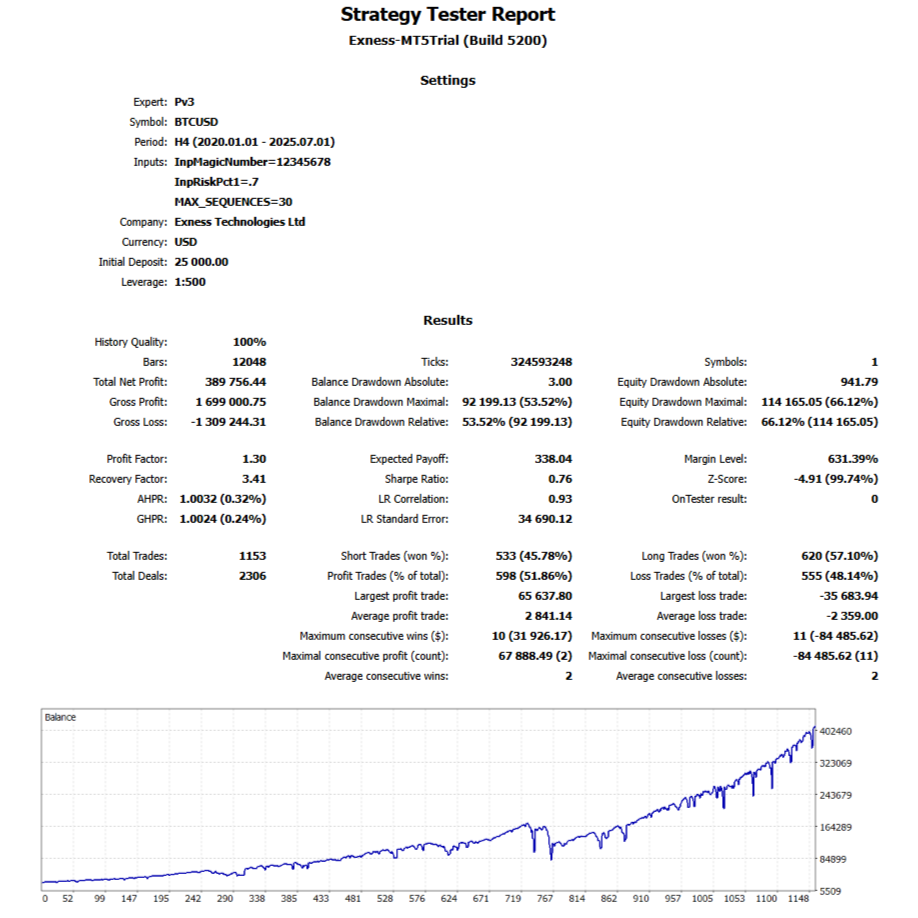

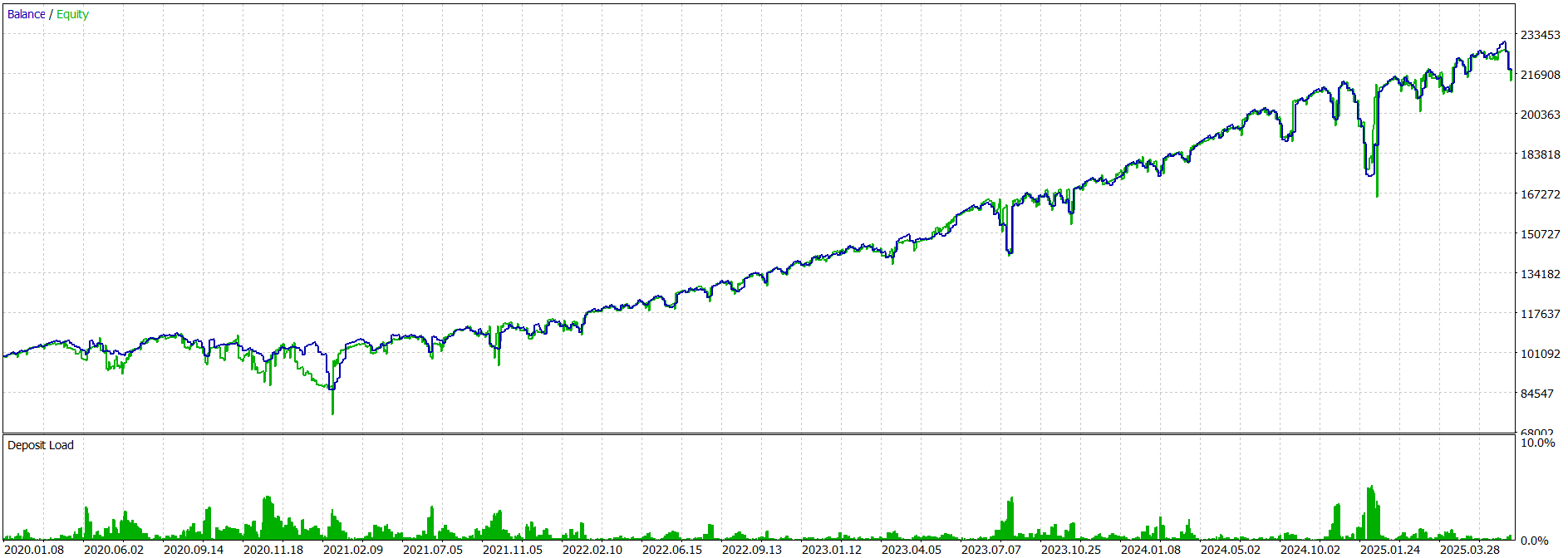

Bitcoin

BTC/USD

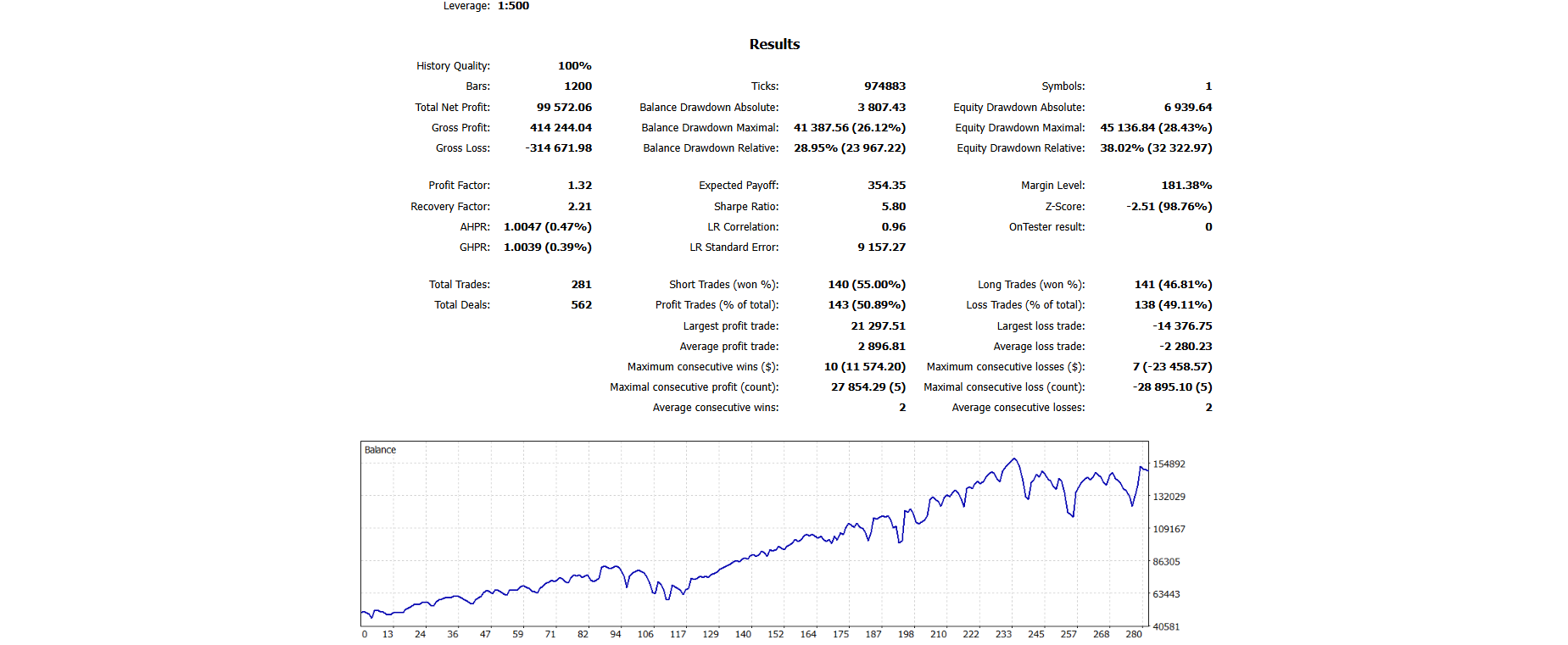

1/1/2020 - 7/1/2025

Max Balance Drawdown | 11.21%

Max Equity Drawdown | 19.26%

Net Return | 301.8%

Return on Risk | 15.67x

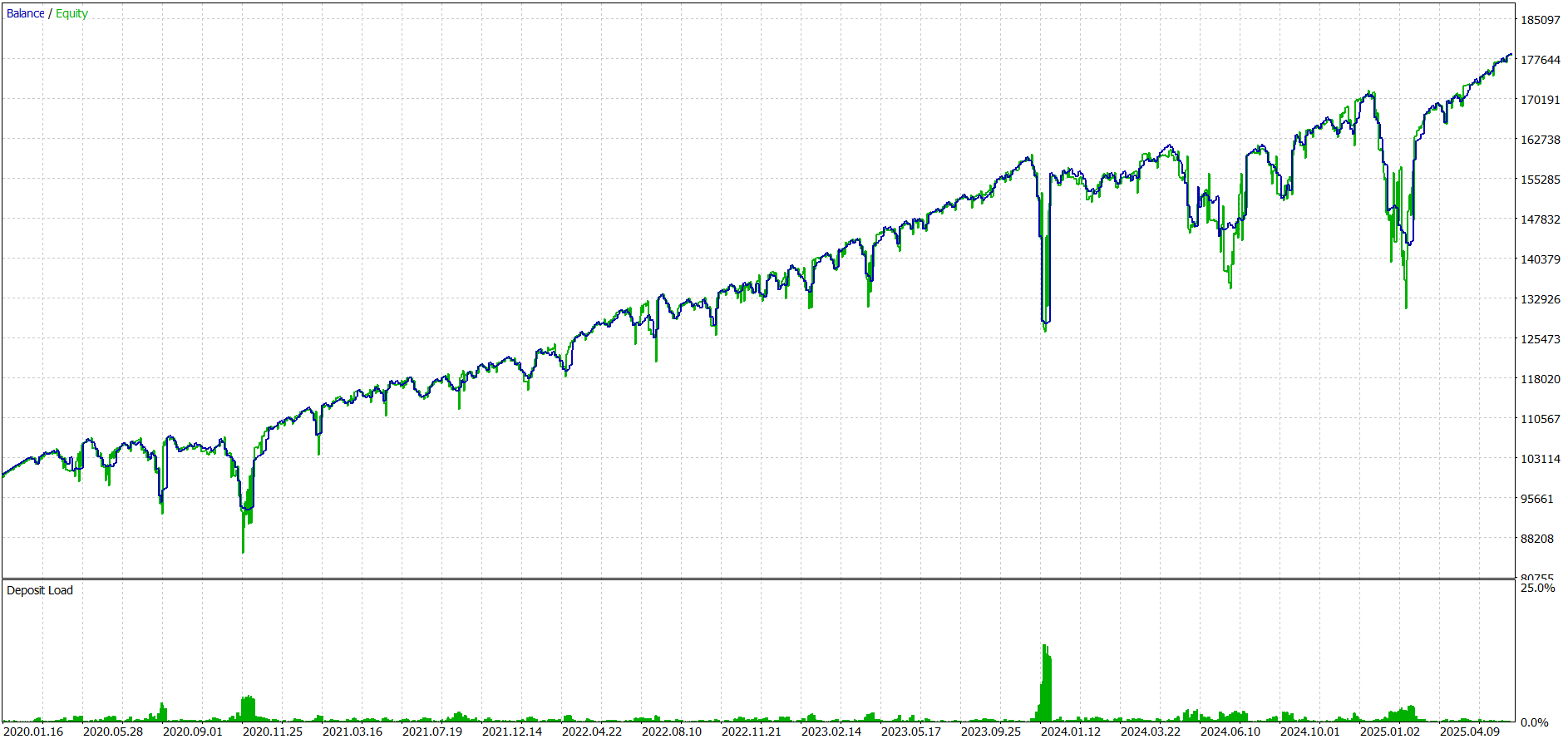

GU

GBP/USD

1/1/2020 - 7/1/2025

Max Balance Drawdown | 21.82%

Max Equity Drawdown | 23.38%

Net Return | 247.74%

Return on Risk | 10.60x

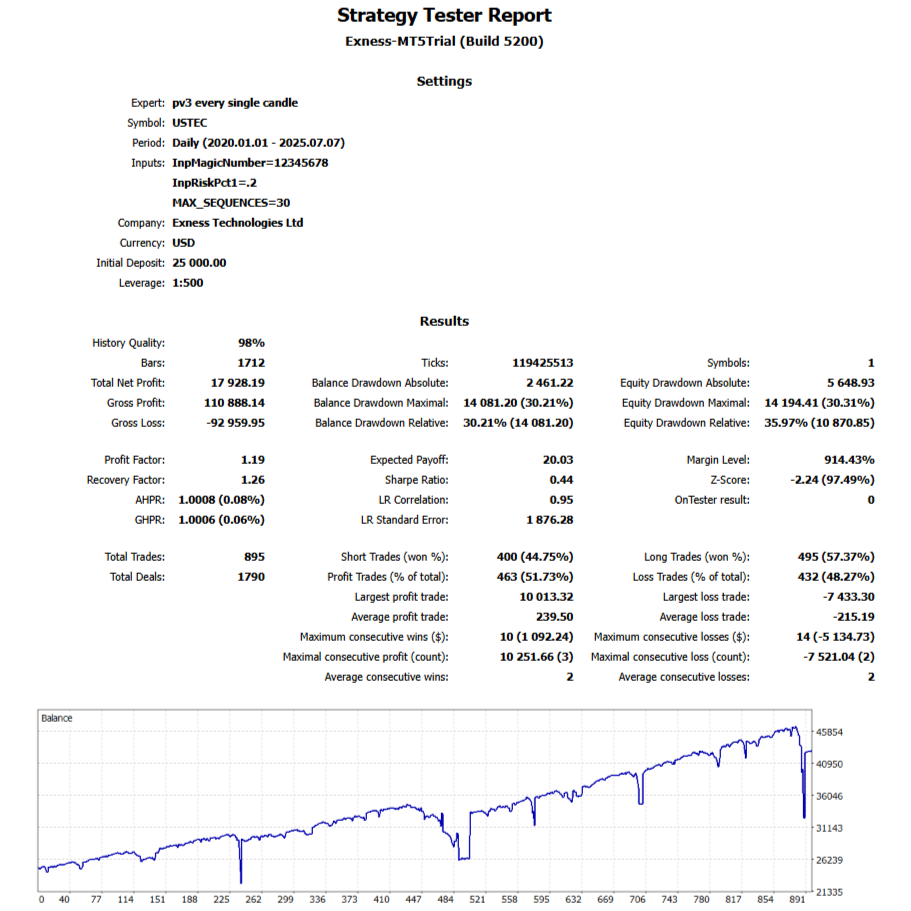

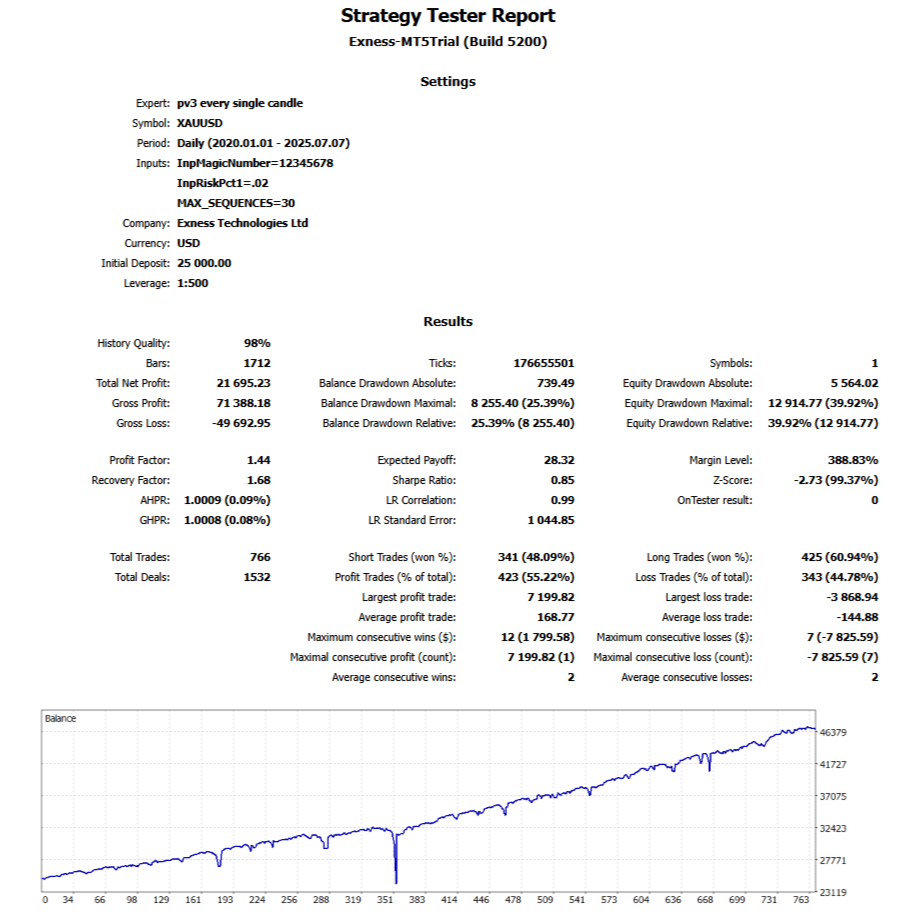

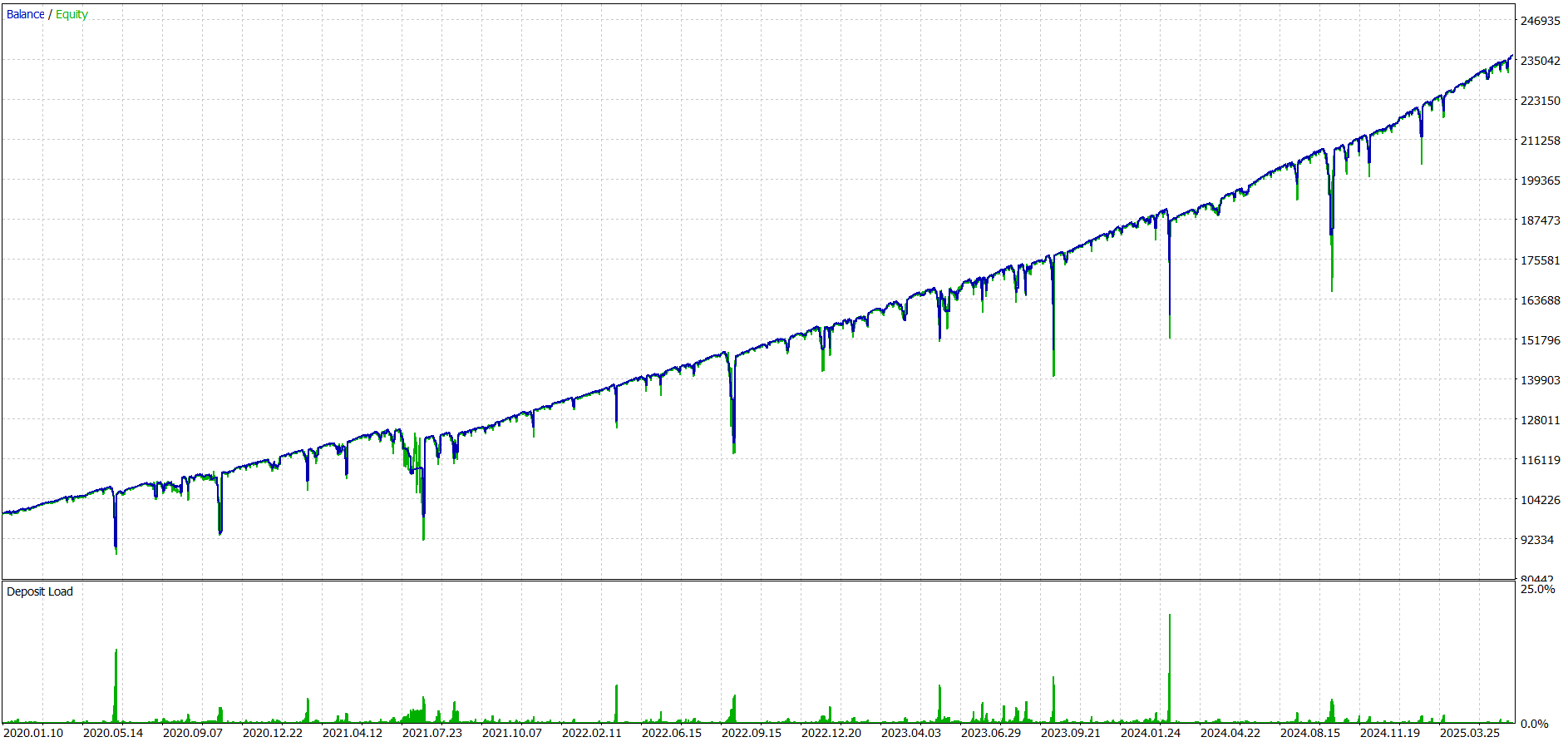

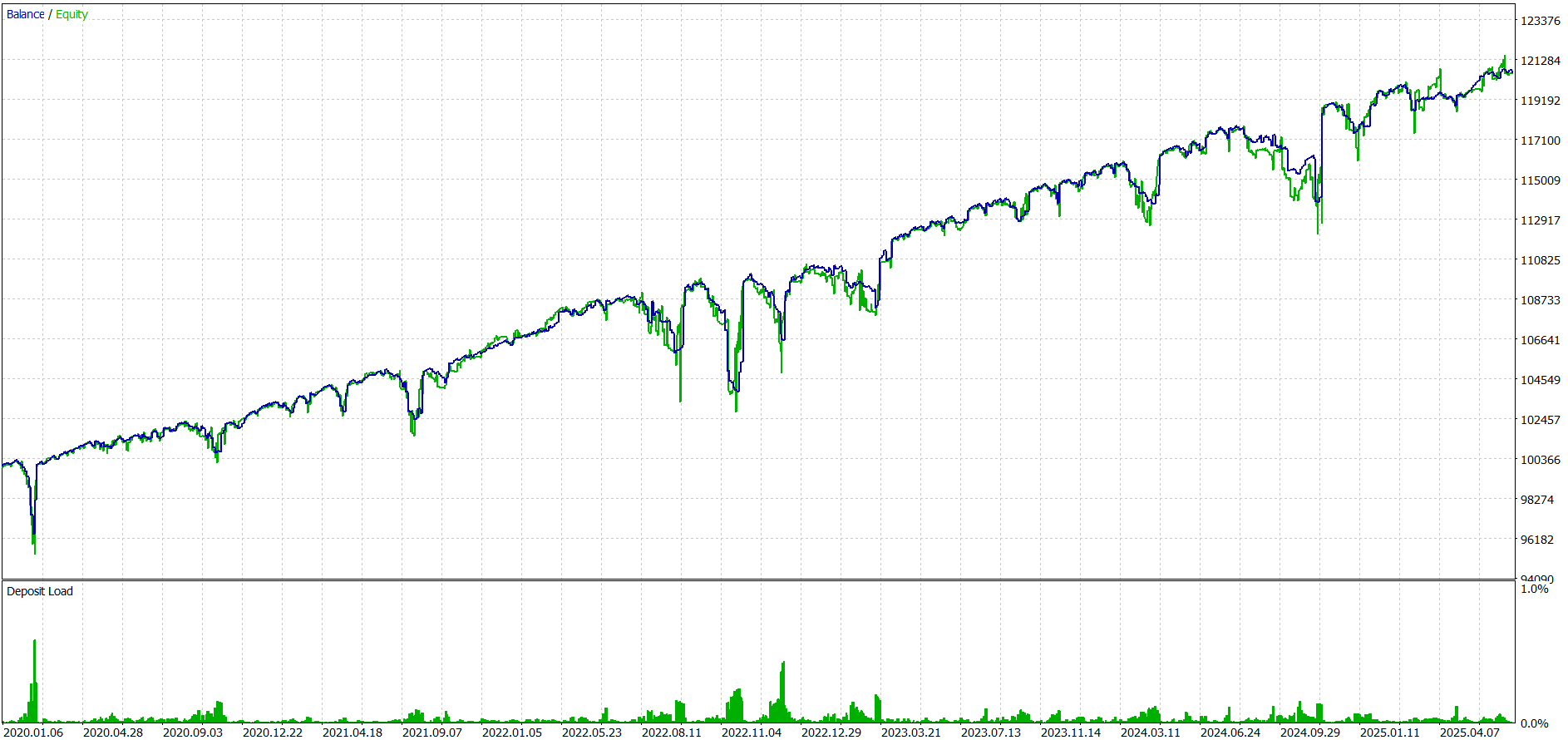

Gold

XAU/USD

1/1/2020 - 7/1/2025

Max Balance Drawdown | 16.54%

Max Equity Drawdown | 20.23%

Net Return | 136.47%

Return on Risk | 6.74x

"The pv3 oracle is essentially an automated, high frequency neural network of trades that all follow one core principle: Robustness.

It's engineered to focus more on the relationship between price and risk behavior, rather than solely price-action; in other words, it prioritizes risk mitigation and elimination rather than just profit maximization. This enables its logic to remain adaptable to all markets, account parameters like capital or risk-budget, and broker conditions like spread or leverage, allowing it to produce profit smoothly regardless of market behavior."

- qs Dev, Sonty

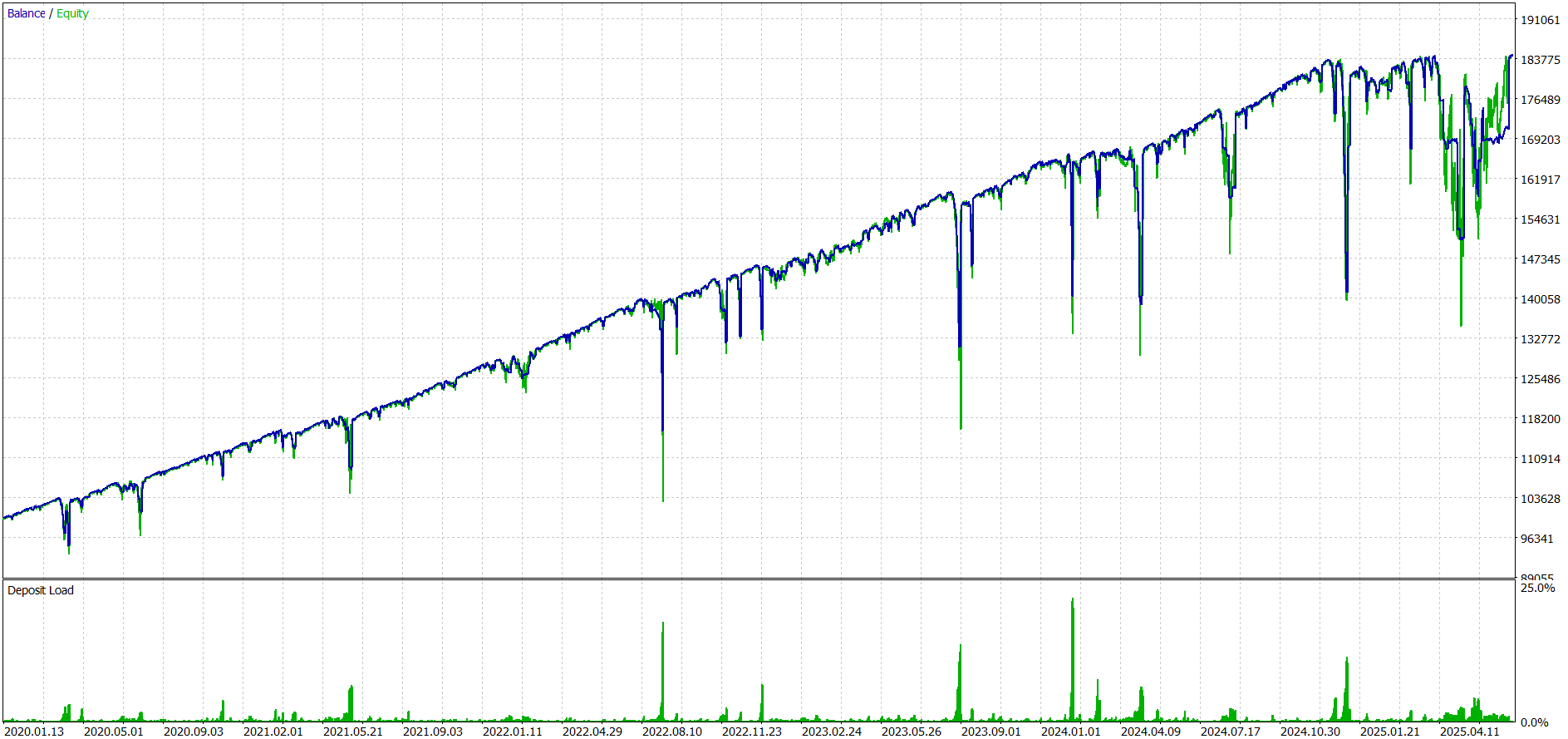

UJ

USD/JPY

1/1/2020 - 7/1/2025

Max Balance Drawdown | 18.40%

Max Equity Drawdown | 22.43%

Net Return | 118.30%

Return on Risk | 5.27x

EU

EUR/USD

1/1/2020 - 7/1/2025

Max Balance Drawdown | 19.50%

Max Equity Drawdown | 23.76%

Net Return | 78.57%

Return on Risk | 3.31x

XRP

XRP/USD

1/1/2020 - 7/1/2025

Max Balance Drawdown | 5.35%

Max Equity Drawdown | 6.36%

Net Return | 20.61%

Return on Risk | 3.24x

CJ

CAD/JPY

1/1/2020 - 7/1/2025

Max Balance Drawdown | 23.14%

Max Equity Drawdown | 26.82%

Net Return | 84.32%

Return on Risk | 3.14x

Solana

SOL/USD

1/1/2020 - 7/1/2025

Max Balance Drawdown | 1.36%

Max Equity Drawdown | 1.43%

Net Return | 3.79%

Return on Risk | 2.65x

Ethereum

ETH/USD

1/1/2020 - 7/1/2025

Max Balance Drawdown | 1.14%

Max Equity Drawdown | 1.94%

Net Return | 3.81%

Return on Risk | 1.96x

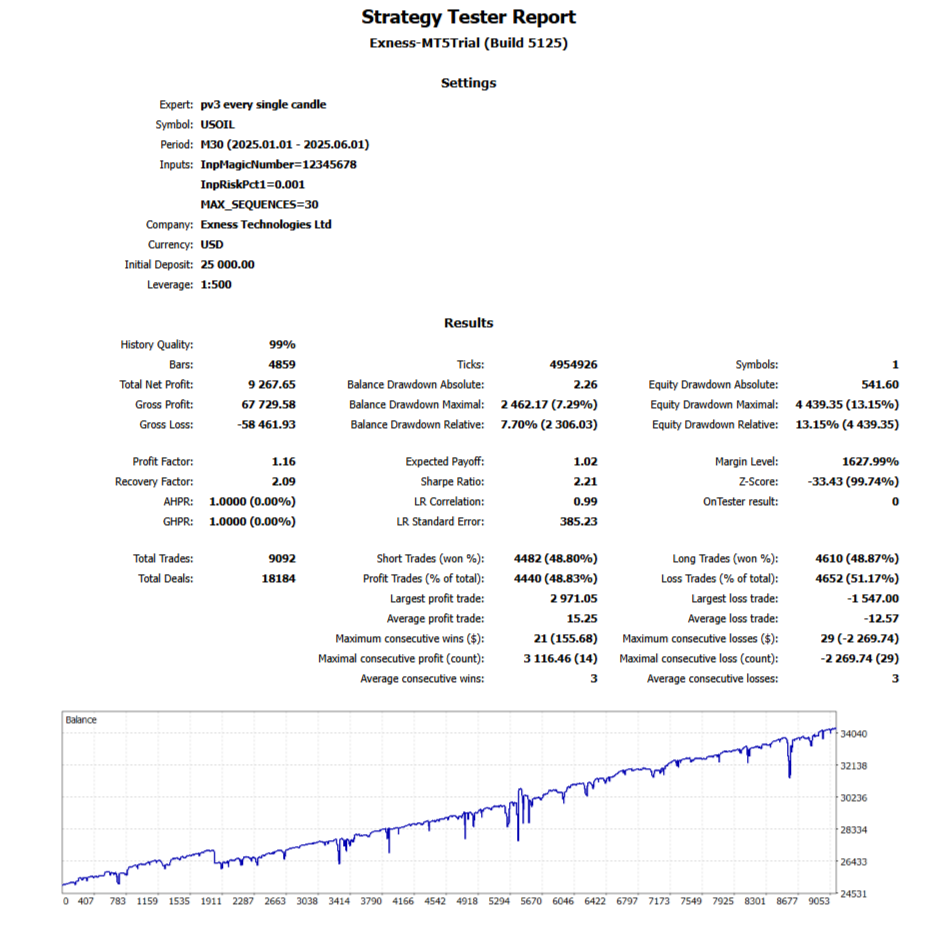

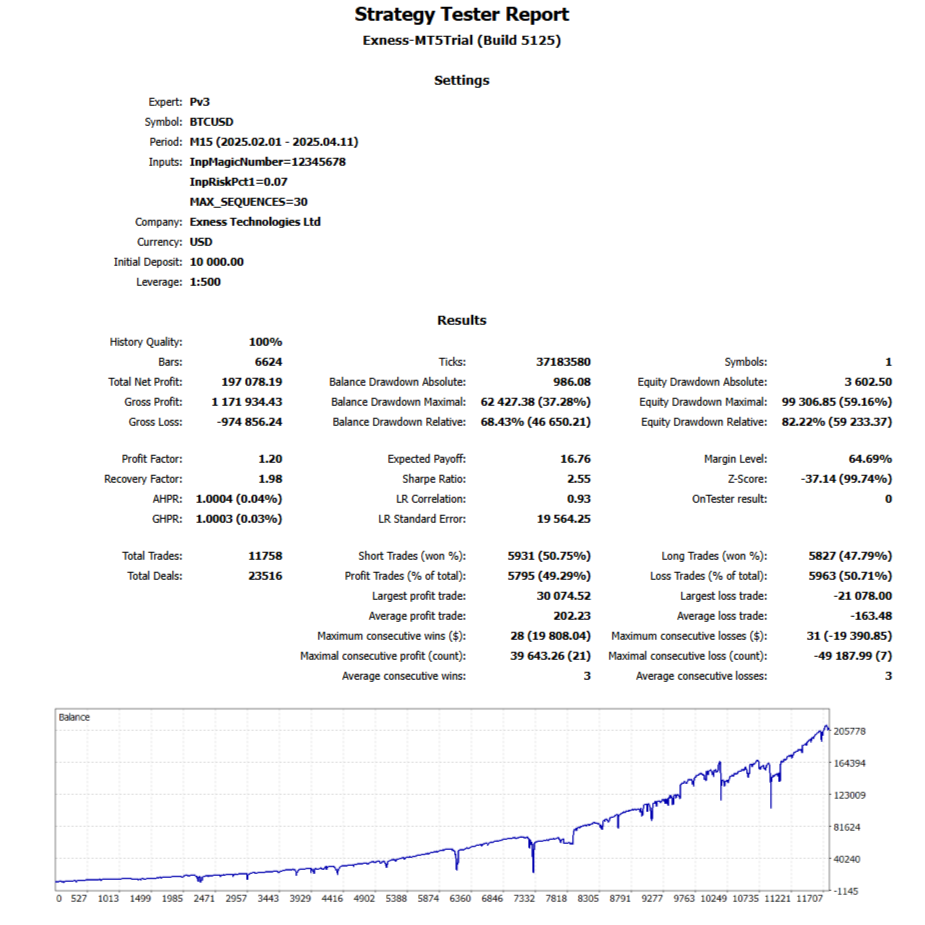

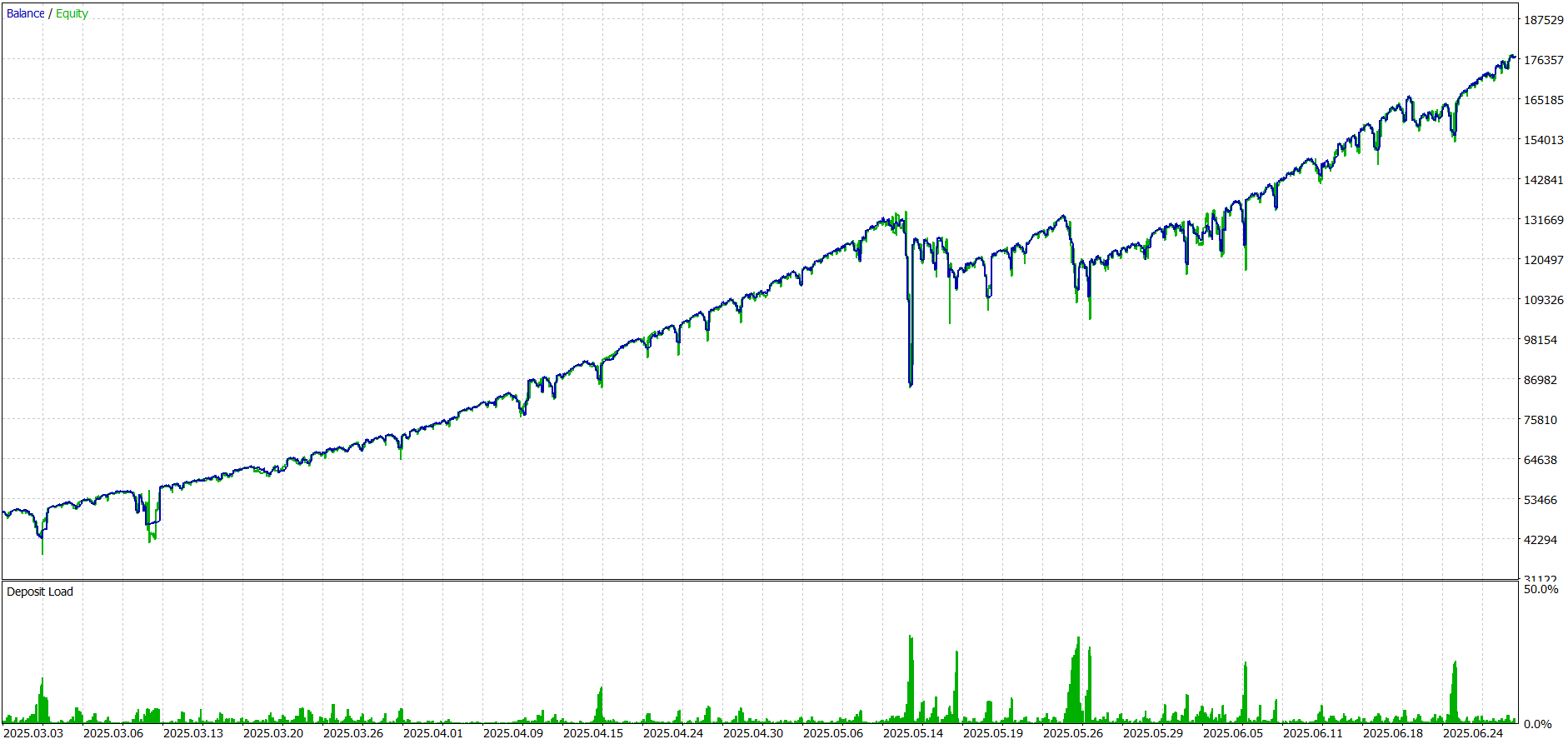

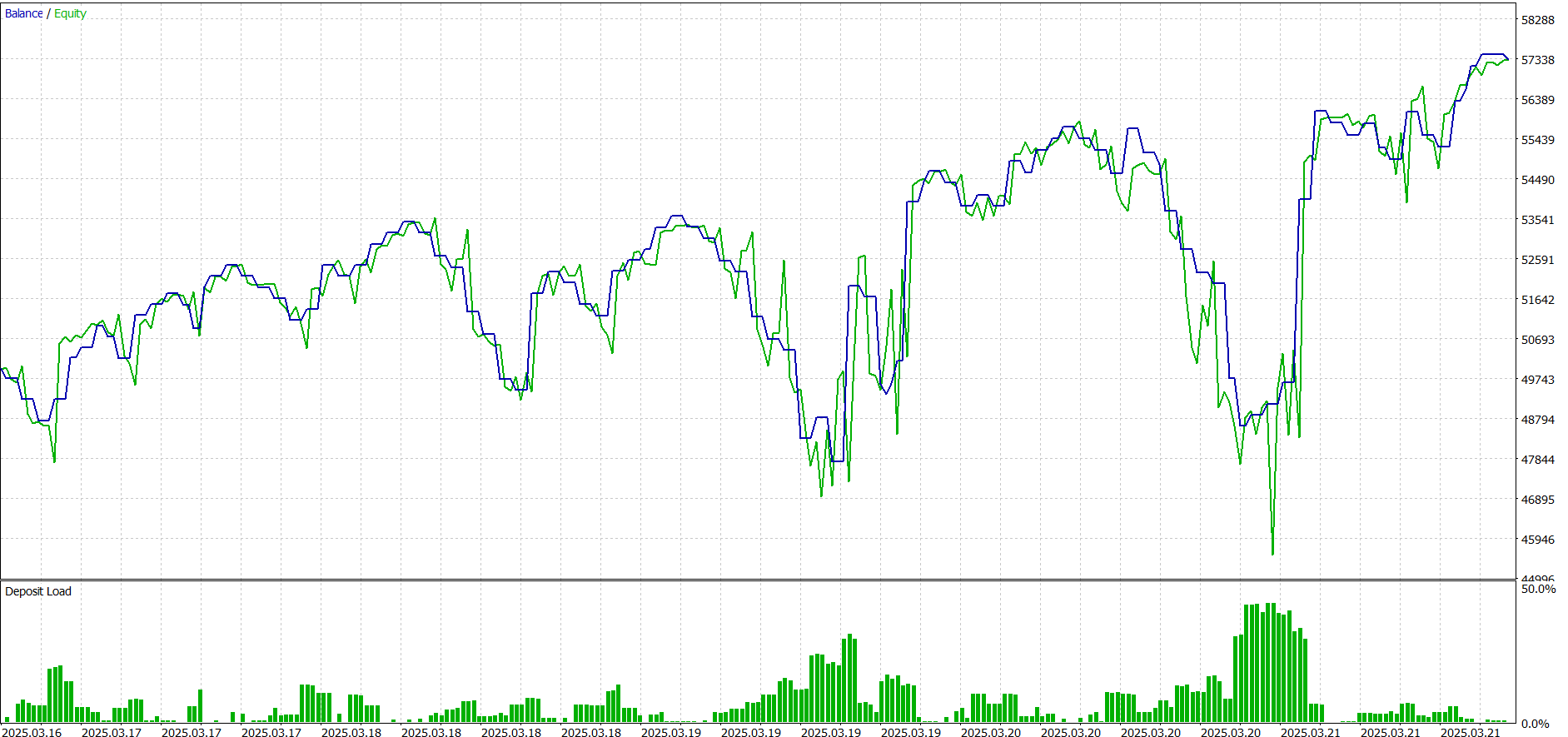

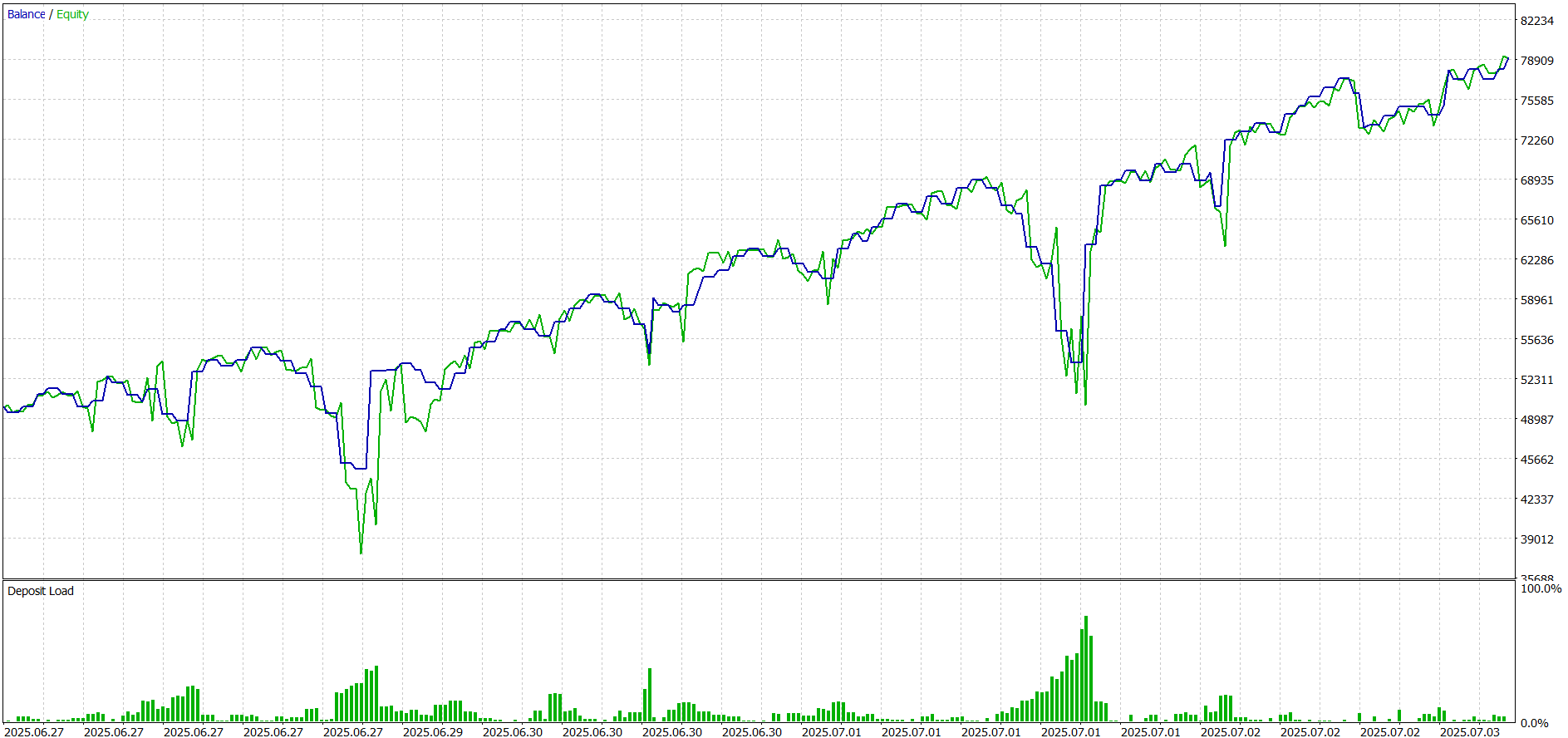

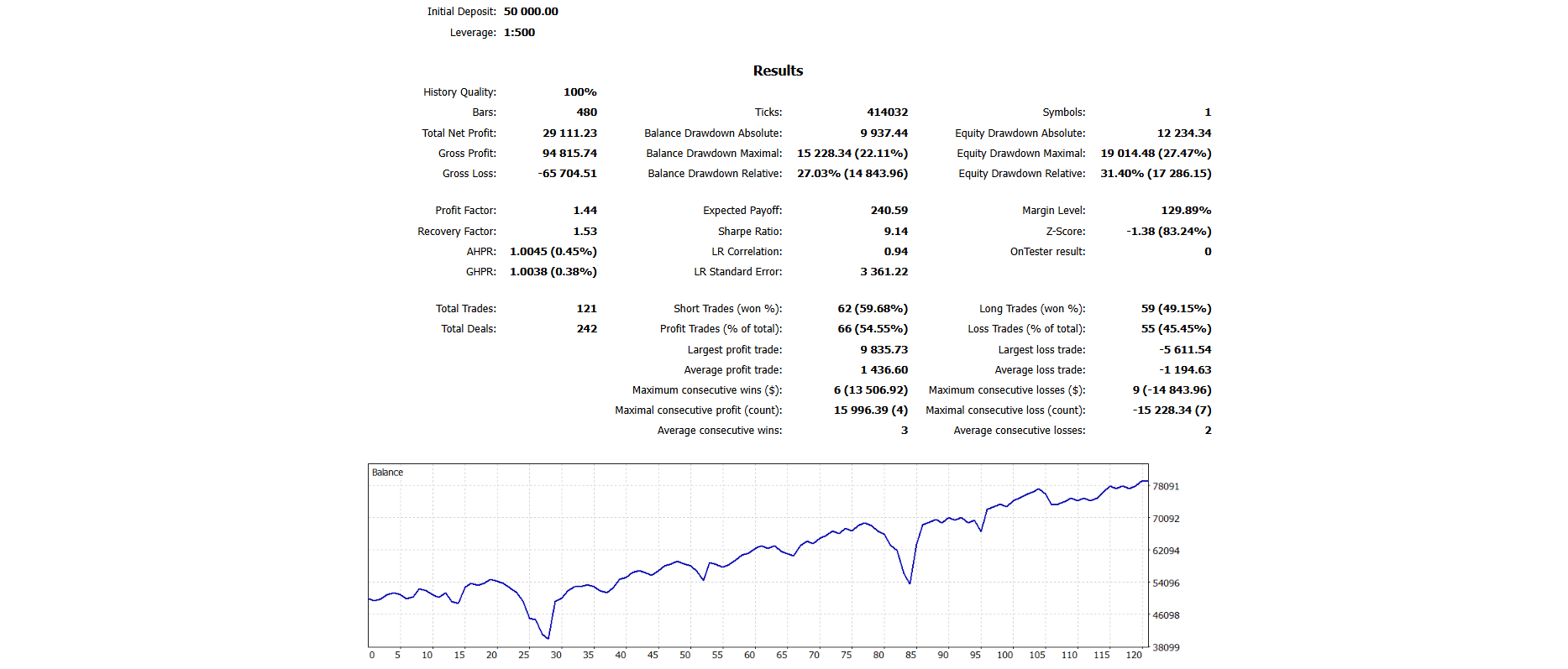

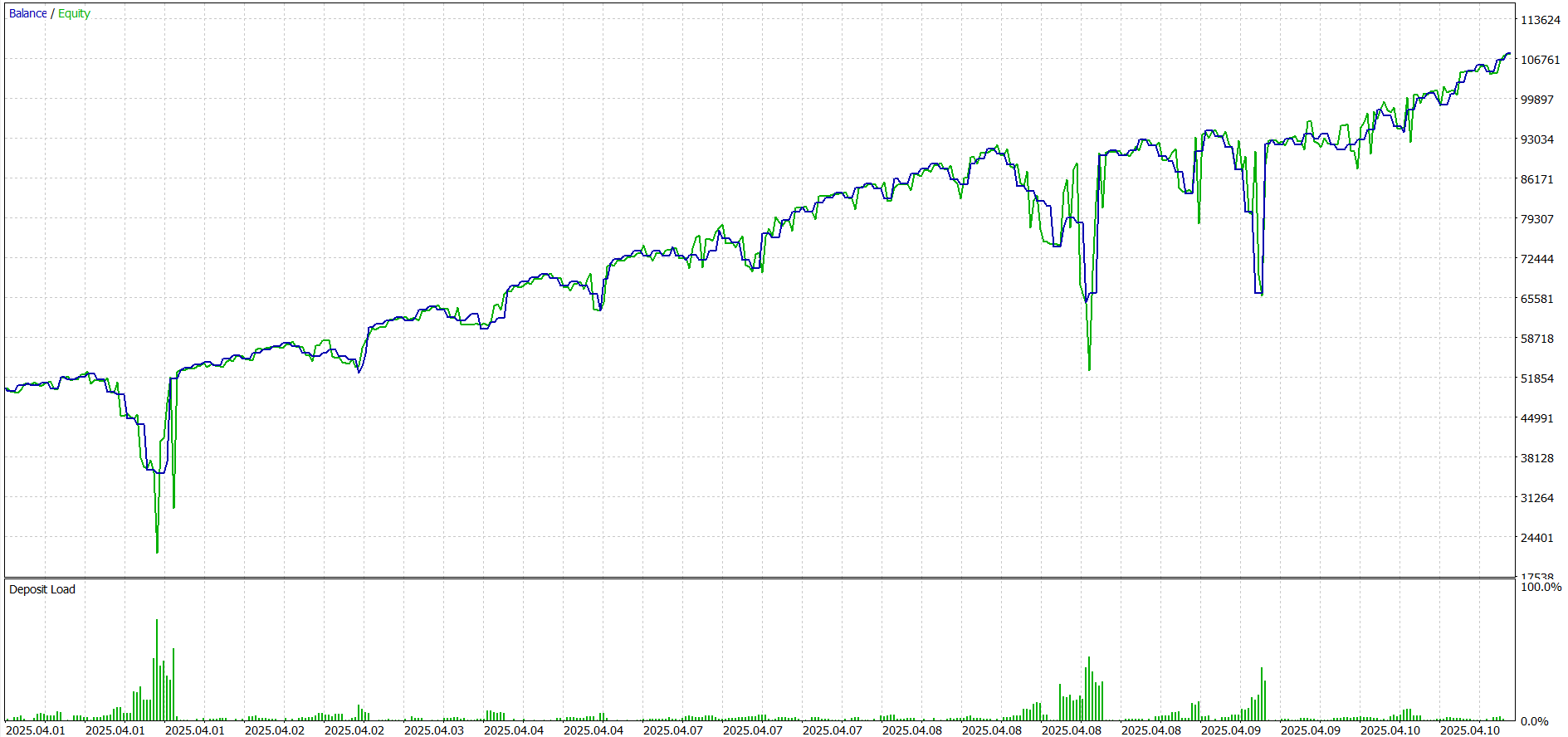

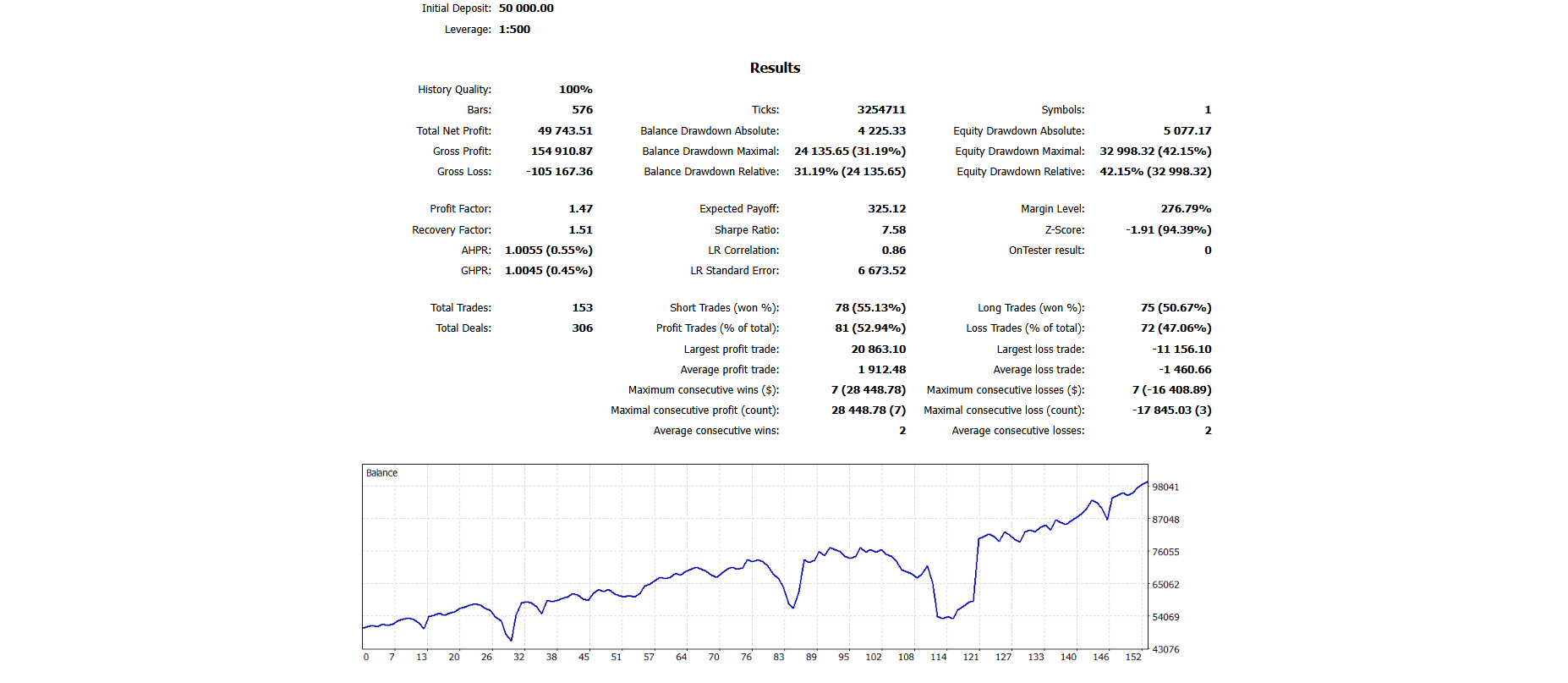

Scalping Intervals

Highlighting a more realistic view of the oracle's short-term potential, here are a few intraweek/monthly trading periods that better reflect pv3's performance under higher-frequency execution and fully deployed risk.

"The gap between today and the future is only tomorrow."

Blockchain integration and model tokenization is in the works.

Don't miss out on the fun[d] updates

Subscribe to our email to receive important updates on infrastructural development, investable assets, collaboration opportunities and more!

Think our visions align?

We value your input. If you think our visions align, we'd like to chat and possibly work with you. Right now we're looking to connect with web3 integrators, blockchain engineers, smart contract developers, trading influencers, venture capitalists, and more. Whether you bring technical expertise, capital, strategic insight, or even just a strong perspective, we’re open to conversations that move the vision forward.